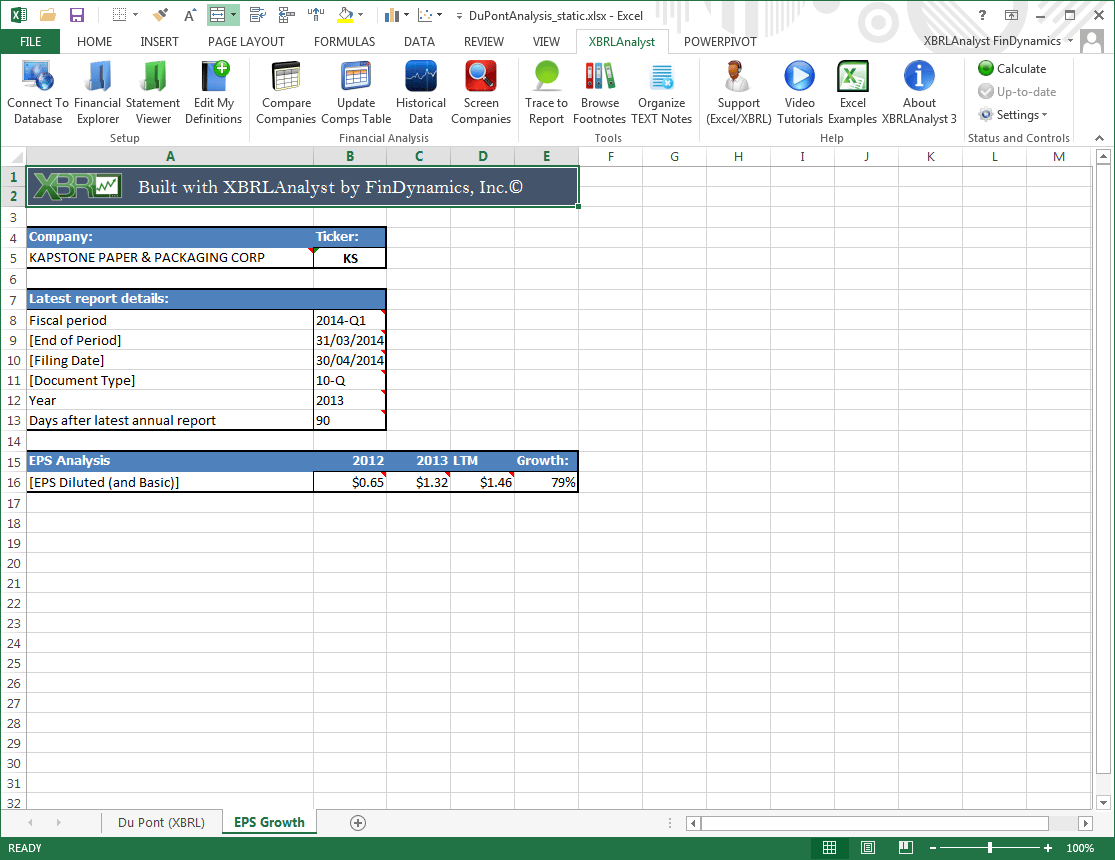

Dupont Analysis Template

Dupont Analysis Template – The DuPont analysis is the basis for the analysis of the main results popularized by the DuPont Corporation. DuPont analysis is the main technique used to break down the various drivers of return on equity (ROE). Decomposing ROE allows investors to focus on individual key financial metrics to identify strengths and weaknesses. There are two types of tools – one that decomposes into three steps and the other into five steps.

DuPont analysis is a formula used to track a company’s financial performance. It was invented in 1914 by F. Donaldson Brown, who worked for the DuPont Corporation. His formula includes income, investment and capital employed together into a figure called return on investment (ROI). It has become the benchmark for all DuPont companies and has been adopted by other companies.

Dupont Analysis Template

The DuPont analysis is used to measure the product of a company’s ROE. This allows the investor to determine which activities are most beneficial for changes in ROE. An investor can use such a tool to compare the performance of two similar companies. Managers can use DuPont’s analysis to identify strengths or weaknesses that need to be addressed.

Pdf) Profitability Of Cooperative Banks With Dupont Analysis: Evidence Of Greek Banking System

Dupont’s analysis is the increasing return on equity model, calculated by multiplying the income of the property by the equity ratio.

DuPontAnalysis = NetProfitMargin × AT × EM where: NetProfitMargin = NetIncome AT = Assetturnover AssetTurnover = Sales AverageTotalAssets EM = Equitymultiplier EquityMultiplier = AverageTotalAssets AverageShareholders Equity begintext &f. \ &text = frac } \ &text = text \ &text = frac } \ &text = text \ &text = frac } } end DuPontAnalysis = NetProfitMargin × AT × EM where: NetProfitMargin = NetIncome AT = Asset Turnover AssetTurnover = AverageTotalAssets Sales EM = Equitymultiplier EquityMultiplier = Average Shareholders’ Equity AverageTotals

DuPont’s analysis breaks down ROE into its components to determine which of these factors are most responsible for changes in ROE.

Financial Reporting And Analysis • Formulas Cfa® Level 1 • 365 Financial Analyst

Profit margin is the ratio of bottom line profit to total revenue or total sales. This is one of the most important measures of profitability.

One way to think about interest rates is to think of a store that sells for $1.00. After paying the cost of purchasing, maintaining a location, staff, taxes, interest and other expenses, the store owner keeps $0.15 in revenue from each store. That means that the owner’s income is 15%, which can be calculated as follows:

ProfitMargin = NetIncome = $0.15 $1.00 = 15% begin &text = frac } } = frac = 15% end ProfitMargin = NetIncome = $1.00 $0.15 = 15%

Dupont Analysis Using Marketxls (excel Spreadsheet)

Profitability can be improved by reducing costs to the owner or increasing costs, which can affect ROE. This is one of the reasons why there can be high volatility in a company’s stock when management changes its direction on future financials, prices and the costs.

The asset turnover ratio measures how well a company uses its assets to generate revenue. Imagine that a company has $100 in assets, and made $1,000 in gross profit last year. Assets generate 10 times their value in total income, which is equal to the assets transfer and can be calculated as follows:

AssetTurnoverRatio = Average Assets Income = $1 , 000 $100 = 10 begin &text = frac } } = frac = 10 end AssetTurnoverRatio = Average Assets Income = $100 $1 = $100 $1 = $100 $1

Enterprise Profit Analysis Statement Png Transparent Images Free Download

A transferable asset may vary from one business group to another. For example, a discount store or a grocery store will make a lot of money from its assets with a small interest rate, resulting in huge assets. On the other hand, a utility company has expensive assets relative to its revenue, which results in a lower asset value than a retail business.

The ratio is helpful when comparing two similar companies. Because average assets include items such as inventory, changes in this ratio can indicate that sales are slower or faster than other financial measures would indicate. If a company’s net assets increase, its ROE improves.

Financial leverage, or the equivalent, is an indirect measure of a company’s use of debt to finance its assets. Assume a company has $1,000 in assets and $250 in owner’s equity. The balance sheet will show you that the company still has $750 (assets – liabilities = equity). If the company borrows more money to buy assets, the ratio will increase. The funds used to calculate income are both on the balance sheet, so analysts will divide average assets by the average balance rather than the ending balance. of time, as follows:

Curriculum Video Modules Hub

FinancialLeverage = AverageAssets AverageEquity = $ 1 , 000 $ 250 = 4 begin &text = frac } } = frac = 4 end FinancialLeverage = Average Equity AverageAssets = $250 $1 , 00

Most companies must use debt with equity to finance business and growth. Without efforts, the company will be at a disadvantage compared to its peers. However, using too much debt to increase operating income – and therefore increase ROE – can create unacceptable risk.

One point to keep in mind, however, is that some companies use a newspaper balance sheet where one of the items is income measurement. In the aforementioned case, no average is necessary as the balance sheet/balance sheet is calculated in the equation.

Lynch Screen (screening Stocks Using Excel)

The return on equity metric is income divided by shareholders’ equity. The Dupont review is still ROE, but extended. The ROE calculation alone shows how well the company is using capital from shareholders.

With Dupont’s analysis, investors and analysts can understand the changes in ROE, or why ROE is considered high or low. That is, Dupont’s analysis can help determine whether profits, asset utilization, or expenses are driving ROE.

The main disadvantage of the DuPont analysis is that, while it is comprehensive, it relies on numerical equations and data that can be modified. Also, even with his insights, Dupont’s analysis doesn’t detail why the comparator is high or low, or whether they should be considered high or low at all.

Roe Vs Roa

Here is a hypothetical example that shows how the DuPont analysis works. Let’s say an investor is looking at two similar companies, SuperCo and Gear Inc. These two companies have improved their return on equity with the rest of their peers, which could be a good thing if both companies use assets better. or improve income.

To determine which company is the better opportunity, the investor decides to use DuPont’s analysis to determine what each company is doing to improve its ROE and whether Is that development safe?

As you can see in the table, SuperCo improves its profitability by increasing its income and reducing its total investment. SuperCo’s changes have improved its income and asset turnover. An investor will know that SuperCo is also reducing some of its debt because the average equity remains the same.

Inside Atlassian: Example Jira Workflows For Tracking Blog Projects

Looking closely at the Gear, investors can see that all the changes in ROE are due to financial increases. This means that the more the company borrows, the lower the average equity. The investor is concerned because the additional debt has not changed the company’s income, profit or loss. Therefore, the leverage will not add any real value to the company.

So, from these figures, we can use the above information to make sure that the company has the following:

Based on this information, Walmart’s return on equity (ROE) for the fiscal year is 5.5% (or 0.8% x 2.22 x 3.12).

Time Series Dupont Analysis With Return On Equity

DuPont analysis is a useful technique used to break down the various drivers of business return on equity. This allows the investor to determine which activities are most likely to affect changes in ROE. An entrepreneur can use this kind of analysis to compare the performance of two similar companies.

There are two versions of the DuPont analysis, one using a three-step ROE decomposition and the other using a five-step method. The three-step ROE equation does three very important things:

ROE = Net Income × Stock × Stockholders’ Equitybegin &text= frac } } times frac } } times frac } } end ROE = Net Sales Revenue × Inventory × Owners’ Assets

Technofunda Investing Screener Excel Template

ROE = EBTS × SA × AE × (1−TR) where: EBT = Earnings before taxS=SalesA=AssetsE=EquityTR=Tax ratebegin &text=frac } } times frac } } times frac } } times (1 – text) \ &textbf \ &text = text \ &text = text \ &text = text \ &text = text \ & text = text \ end ROE = S EBT × A S × E A ×

What is dupont analysis, dupont ratio analysis, dupont analysis formula, dupont analysis excel template, dupont analysis explained, the dupont analysis, dupont system of analysis, dupont analysis, dupont financial analysis, dupont analysis example, dupont analysis interpretation, dupont analysis roa

Thank you for visiting Dupont Analysis Template. There are a lot of beautiful templates out there, but it can be easy to feel like a lot of the best cost a ridiculous amount of money, require special design. And if at this time you are looking for information and ideas regarding the Dupont Analysis Template then, you are in the perfect place. Get this Dupont Analysis Template for free here. We hope this post Dupont Analysis Template inspired you and help you what you are looking for.

Dupont Analysis Template was posted in March 25, 2022 at 8:20 pm. If you wanna have it as yours, please click the Pictures and you will go to click right mouse then Save Image As and Click Save and download the Dupont Analysis Template Picture.. Don’t forget to share this picture with others via Facebook, Twitter, Pinterest or other social medias! we do hope you'll get inspired by SampleTemplates123... Thanks again! If you have any DMCA issues on this post, please contact us!