Secured Promissory Note Template Word

Secured Promissory Note Template Word – Nevada power of attorney forms are documents that allow a person (the “principal”) to appoint another person (the “agent”) to represent them in financial or medical matters. There are several types of powers of attorney that can be delegated to an agent. The principal will have to choose which powers will be delegated to the agent. Regardless of the type of power of attorney, these documents serve the same purpose, to legally appoint someone else to act on your behalf to act and make decisions about your affairs as if the agent were the principal.

Lasting (Legal) Power of Attorney – Allows one person (the “principal”) to choose someone else to handle financial matters. The form remains valid if the principal becomes disabled.

Secured Promissory Note Template Word

General (Financial) Power of Attorney – This form also conveys general financial rights over the property, but unlike the durable form, it becomes ineffective and void upon the incapacity of the principal.

Unsecured Promissory Note Templates (free) [word, Pdf, Odt]

Limited Power of Attorney – This form allows the principal to authorize an agent for a specific event or for a limited period of time.

Medical Power of Attorney – This document gives legal authority to someone else to make health care decisions for the principal when they are unable to do so themselves.

Minor (Child) Power of Attorney – This form allows a parent to give someone else the authority or care and support of their children. This is usually used when parents are expected to be away and unavailable for a period of time.

Promissory Note Sample: Fill Out & Sign Online

Revocation of Power of Attorney – This form is used to terminate a previous POA. It is important that this form is used to notify the agent and others that you are canceling the POA.

Power of Attorney for Real Estate – Allows you to appoint an agent to act on your behalf regarding your real estate, such as selling or closing, authorizing leases, etc.

Tax Attorney Form – This form provides a way in which you can authorize a tax professional or someone else to handle your tax matters before the tax authorities.

Promissory Note Pdf

Vehicle Power of Attorney (Form VP136) – This form allows you to authorize someone else to act on behalf of your interests in a motor vehicle – usually to carry out a title or registration application.

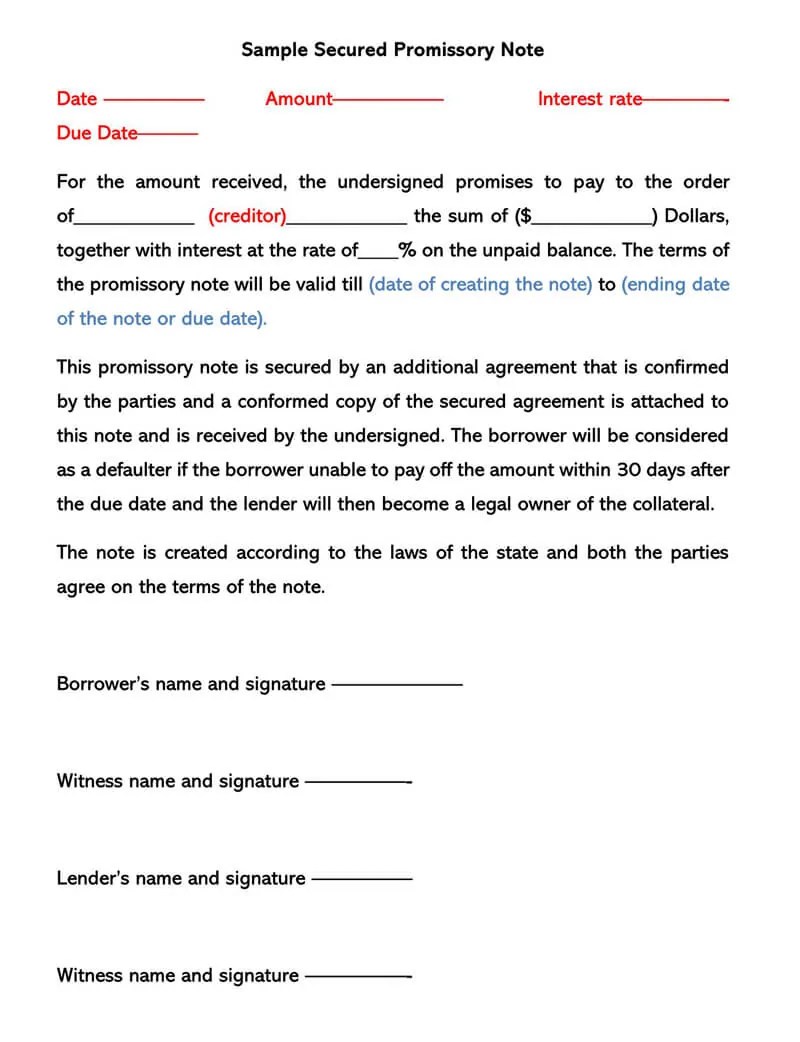

By using the website, you agree to our use of cookies to analyze website traffic and improve your experience on our website. A promissory note can be a great way for both lenders and borrowers to benefit from a loan. A secured promissory note is a binding agreement between two parties, guaranteeing repayment after the advance of funds. It is considered more powerful than an IOU, but not as strong as a formal loan agreement that you might receive from a bank or other lending institution.

Promissory notes help reduce the risk that lenders take when they extend loan offers to borrowers in need. With a binding document in hand, the lender has a legal recourse to recover any money lost due to non-payment.

Secured Promissory Note Templates (free) [word, Pdf, Odt]

At the corporate level, loans secured by promissory notes can be a great investment opportunity for companies. However, these loans are usually large and require registration with the SEC. You may also see promissory notes used during the final stages of a home purchase when the borrower is applying for a mortgage.

There are two types of promissory notes – secured and unsecured. Each has benefits, and you need to decide which type of agreement works for your particular situation.

A secured note is also called a promissory note with collateral. It is an agreement in which the borrower offers guarantees that the lender can demand in case of non-payment. This collateral can take the form of vehicles, real estate or other valuable assets. The asset considered must always be equal to or greater than the value of the loan.

Promissory Note Installment Payment Clean Unsecured

Any type of collateral does not guarantee an unsecured loan. Since these loans are usually risky, they come with a higher interest rate to protect the lender. Common unsecured loans you may see are student loans and credit cards.

If you are considering lending an amount, it is recommended to create a promissory note in case of default. To do this, you can find a secure promissory note template that provides the details of the loan, and clearly lists the assets held as collateral. If the borrower defaults, you have a legal document that gives you the right to claim the borrower’s assets as repayment.

A payment note is not considered “secured” without a security agreement. If you choose a secured note over an unsecured one, you’ll want to create a security agreement that references the loan and attach it to your document.

Download Minnesota Promissory Note Form

Make sure you provide as much detail as you can about warranties. For example, if a vehicle is held as security, including the make, model, color and vehicle identification number, this will ensure that there are no mistakes if you need to recover due to an unpaid loan. As the lender, you will require your borrower to sign a security agreement that includes this description and relates to the loan.

A promissory note secured by real estate can provide strong protection for the lender, but it comes with a few extra steps. First, you must have the borrower sign the promissory note that you have already made and reference the real estate used as collateral.

Once the secured promissory note is signed, the borrower must sign a mortgage agreement, which actually places a lien on the real estate, guaranteeing that the loan will be paid, and in case of default will be transferred to the lender. Sign, witness and notarize this mortgage agreement to make it as enforceable as possible.

Promissory Note Agreement Template & Sample (pdf)

Finally, you must present the pledge and mortgage agreement at the appropriate office in your state. Consult an attorney, either the city/county clerk or other local official, to determine the proper filing method.

In some states, you must use a deed of trust instead of a mortgage agreement as security when financing a loan. A promissory note is secured by a deed of trust, except that a deed of trust is held by a third-party government entity while a mortgage agreement is simply an agreement between the borrower and the lender.

Check your state’s rules on using a trust when creating your secured promissory note.

Promissory Note Template

In the event that a borrower defaults on their loan agreement, the lender has the right to collect the collateral that is guaranteed to them. They are free to repossess the secured property through their own efforts, but it is often more efficient to use professional agencies to perform this task.

If you choose, you can petition the courts. Assuming your promissory note and security agreement are in order, you should have no problem getting a judgment in your favor, strengthening your legal claim to the property.

As a final option, there are companies that specialize in buying unpaid promissory notes. The lender will receive an amount less than the value of the guarantee, and the company will then try to collect the debt with its own resources.

Free Promissory Note

Promissory notes do not need to be notarized to be legally enforceable, as long as both parties have provided their signatures on the document. A secured promissory note is a contract used to ensure that a borrower will repay an amount of money (including interest) to the person or entity that lent it. Since it is “secured”, the borrower must provide one (1) or more assets to serve as collateral. If the borrower defaults on the loan, the lender can take possession of the assets and sell them to pay off the loan. An alternative to this note is the unsecured promissory note, a loan document that removes this security requirement.

Because of the increased security that a secured note offers lenders, they often come with lower interest rates and allow for higher loan limits.

The types of assets that a borrower can use as collateral are broad. As long as the lender can sell the property to cover all (or part) of the loan, it will most likely be accepted. Common items used as collateral include:

Security Agreement And Promissory Note Template In Word, Apple Pages

The borrower must set aside one (1) or more assets that the lender can legally acquire if the loan is not repaid.

While an applicant’s credit score is an essential tool for those lending money, lenders are more likely to lend to someone with a less-than-favorable score because of the added security provided by the asset.

Probably one of the most important sections, the payment section is where the lender notes the due date and the payment plan that the borrower must follow. They have the option of providing the borrower with a lump sum payment or paying in weekly, monthly or quarterly increments.

Secured Promissory Note Template Download Printable Pdf

Some time

Secured promissory note sample, secured promissory note form, secured promissory note template pdf, free secured promissory note template word, promissory note template word, promissory note template word document, secured promissory note template california, secured promissory note template, secured promissory note pdf, secured promissory note template free download, secured promissory note, free secured promissory note template

Thank you for visiting Secured Promissory Note Template Word. There are a lot of beautiful templates out there, but it can be easy to feel like a lot of the best cost a ridiculous amount of money, require special design. And if at this time you are looking for information and ideas regarding the Secured Promissory Note Template Word then, you are in the perfect place. Get this Secured Promissory Note Template Word for free here. We hope this post Secured Promissory Note Template Word inspired you and help you what you are looking for.

Secured Promissory Note Template Word was posted in December 29, 2022 at 8:03 am. If you wanna have it as yours, please click the Pictures and you will go to click right mouse then Save Image As and Click Save and download the Secured Promissory Note Template Word Picture.. Don’t forget to share this picture with others via Facebook, Twitter, Pinterest or other social medias! we do hope you'll get inspired by SampleTemplates123... Thanks again! If you have any DMCA issues on this post, please contact us!