Npv Calculator Excel Template

Npv Calculator Excel Template – If you’re going to use the money now to make future payments—perhaps buying an annuity or bond, taking out a loan, or selling a winning lottery ticket—you’ll want to know what the payments are. worth today. will receive in the future. That’s what it is

, and you can calculate it in any version of Excel or Google Sheets using the present value function.

Npv Calculator Excel Template

:max_bytes(150000):strip_icc()/Clipboard01-618bfd11c29a4e2dbd2a50ea127f34d1.jpg?strip=all)

, which takes into account initial costs. We will cover both of these calculations in this tutorial.

Net Present Value Calculator Clearance, 51% Off

You can use this tutorial in Excel or any version of Excel for Windows or Mac, or in an alternative spreadsheet such as Numbers and Google Sheets. We’ve included our worksheet file, which you can find in the upper left corner of this tutorial, so you can create your own worksheet as you work through the guide to practice your skills.

To calculate present value, you need three pieces of information—interest rate, periods, and payment—and two more—future value and type—in addition:

When specifying the rate and number of periods, make sure the units are consistent. If the payment period is, for example, monthly, remember to use the monthly interest rate. If the aggregates are not consistent, you will get incorrect results.

Di: Estimation Of Irr And Monte Carlo Simulation Of Npv By Excel

Open present value.xlsx and enter the PV workbook or enter the contents of the screenshot below into your spreadsheet and replace the numbers with your own values if you like:

. If that seems odd, you can make it negative by making the monthly payment negative—which may seem odd—or by changing the formula to put a negative sign before the monthly payment (B3). So change the formula to:

:max_bytes(150000):strip_icc()/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg?strip=all)

So, in English, that means a monthly payment of $1,000 over 20 years is over $198,000.

Sensitivity Analysis In Excel

(we count it above). Unlike the standard present value function, the present value function allows for the use of non-equilibrium cash flows.

Note that since the original cost is a cash flow, we must either make it negative in the spreadsheet and add it up.

With these values you can see that you are ahead because it is a positive amount. But you can also see that if you compare the initial cost to the gross income and ignore the current net worth, it’s not that big. Because it covers 10 years and 2% amortization.

Pv Vs Npv

This gives us an income that looks good at first because it costs $6,700, but the NPV calculation shows that this is a losing proposition.

With the present value function, we can estimate how much we are willing to pay for an investment with continuous, regular cash flows. Depending on whether you are the payer or the recipient, you can use this to calculate your car loan or home loan, insurance premium or coupon loan.

With the net present value function, we can estimate whether regular or irregular cash flows are worth the initial investment, taking into account time and initial costs. Both are valuable ways to make the best financial decisions based on facts rather than just instinct.

Free Discounted Cash Flow Templates

Spreadsheets are a powerful tool for making your business and personal financial decisions. If you haven’t followed our previous worksheets for Finance Lessons, check them out:

Note: The purpose of this lesson is not to give you financial advice, but to explain how to use spreadsheets to calculate present value. Consult a qualified financial advisor before making any financial decisions.

Sign up below and we’ll send you a weekly email newsletter. Never forget about the next big thing.

Present Value Excel: How To Calculate Pv In Excel

Bob Fleisser has authored numerous videos and books on Microsoft and Adobe products, and has been a computer educator since the 1980s. He is also a web and multimedia developer. Bob graduated from George Washington University with a degree in financial economics. Time Internal Value of Money (TVM) Present Value (PV) Future Value (FV) Present Value of Growth Opportunities (PVGO) Adjusted Present Value (APV) Present Value (NPV) Compound Interest Liquidity Discount

DCF Model TrainingTerminal ValueEBIATNOPATUUnfixed Free Cash FlowNOPLATADiscount FactMid DCFsInverse DCF Model Annual Contract Capital Compensation DCF ModelCommon DCF Model Errors Football Field Valuation

Discount Rate Capital Structure WACCOShare Price (ke) Capital Investment Pricing Model (CAPM) Beta (β) Equity Risk Premium (ERP) Cost of Debt (kd) Risk-Free Rate (rf) BetaWACC Industry BetaWACC for Individual

Corporate Finance Npv And Irr Spreadsheet Calculator Template

Net present value (NPV) refers to the difference between future cash flows and the present value (PV) of the cash flows.

In practice, net worth is widely used to determine the profitability of a potential investment or project, which can guide investment and operational decisions.

The present value (PV) of cash flows shows how much future cash flows will be expected.

Download Excel Templates

Because a dollar received today is worth more than a dollar received later (aka “time value”), the cash flows must be discounted to today using an appropriate rate of return called the discount rate. interest

Net present value represents the discounted value of future cash flows associated with a particular investment or project.

Unlike the NPV function, which assumes that time periods are equal, XNPV calculates the specific dates that correspond to each cash flow.

Saas Excel Financial Model

Therefore, XNPV is a practical measure of NPV because cash flows occur at irregular intervals.

If the net worth is positive, the project is more likely to be approved. However, please note that the following guidelines mentioned above are generalizations and not strict rules.

For example, a project may be unprofitable, but other non-monetary considerations that help rationalize the decision (eg marketing/non-monetary factors such as publicity and relationship building) are taken up by management.

Cash Flow Indicator Ratios Excel Template Calculator

The project’s initial investment in year 0 is $100 million, and the project’s cash flows start at $20 million in year 1 and increase by $5 million each year until year 5.

Time error from 0 to 1 year (and why XNPV is recommended over the NPV function).

The number of periods in Excel can be calculated by using the “YEARFRAC” function and selecting two dates (ie start and end dates).

Npv, Irr & Payback Calculator Template

If we add up all the cash inflows and outflows, we get another $17.3 million in net worth.

Subscribe to Premium Package: Financial Accounting Modeling, DCF, M&A, LBO and Comps. The same training program used by top investment banks.

We are now sending the requested files to your email. If you do not receive an email, please check your spam folder before requesting the files again.

Npv Calculator (excel Template)

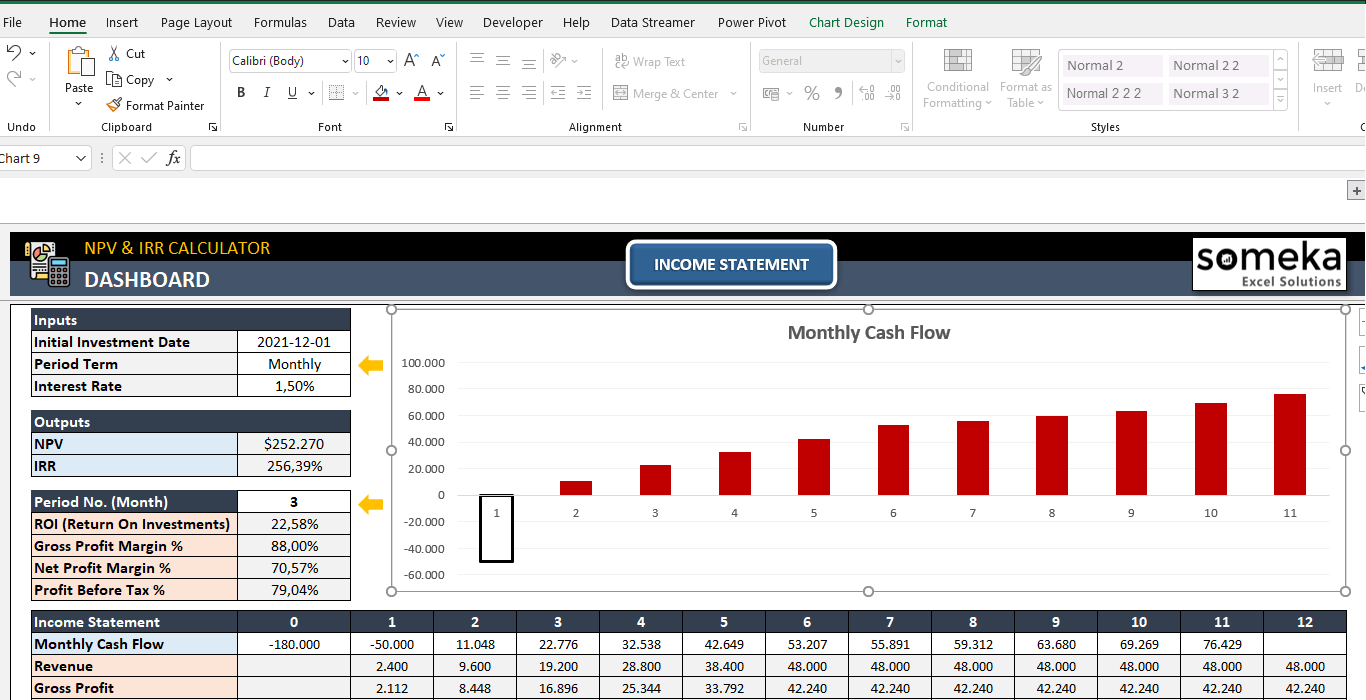

Get instant access to video tutorials taught by experienced investment bankers. Learn Financial Accounting Modeling, DCF, M&A, LBO, Comps and Excel shortcuts. A professional Excel spreadsheet for calculating NPV and IRR. Estimate monthly cash flow and feasibility. Ready for shows. Managing dynamic schedules.

One of the methods of feasibility study is to check the NPV and IRR values of the project. After you enter your projected cash flows, the NPV and IRR calculator Excel template will show you the net present value and internal rate of return for the project.

Net present value is an important indicator for determining present value after all income and cost assumptions. Estimating the rate of return and the present value of your cash flow can be difficult. But they will shape the business you are about to start. Both the value of your company and the capital of your projects.

Spreadsheets For Finance: Calculating Present Value And Net Present Value

The Net Present Value Calculator model is a tool that calculates the difference between the present value of income and the present value of cash flows over a period of time.

This Excel spreadsheet with NPV and IRR calculator collects information about future cash flows and divides them by discount rates to determine the present value of each cash flow. The sum of the present value of all cash flows forms the net present value formula.

First, in the NPV Spreadsheet and IRR Calculator template, you need to enter your information in the Cash Flow and Income section. Enter only the estimated cash flow in the white cells. When you change the “Episode” on the dashboard, the engagement changes accordingly.

Calculate Effective Rent Excel Spreadsheet

If you select an annual period as the period, the model calculates ROI as the net profit/initial investment for that period.

ROI in a monthly period is calculated as net income (specified month) / initial investment (zero period).

When the correct estimated values are entered, it displays a graphical graph of cash flows and outflows, net present value and internal rate of return.

Net Present Value Calculator » The Spreadsheet Page

Additionally, you can enter projected cash flows into the spreadsheet or use the income statement to calculate a well-estimated cash flow.

To help you determine your exact cash flow, take a look at our cash flow template

Npv and irr calculator excel, npv model excel template, npv excel calculator, npv template excel, npv sensitivity analysis excel template, npv calculator in excel, marketing roi calculator excel template, npv analysis excel template, npv irr excel template, npv irr calculator excel template, npv excel spreadsheet template, roi calculator excel template

Thank you for visiting Npv Calculator Excel Template. There are a lot of beautiful templates out there, but it can be easy to feel like a lot of the best cost a ridiculous amount of money, require special design. And if at this time you are looking for information and ideas regarding the Npv Calculator Excel Template then, you are in the perfect place. Get this Npv Calculator Excel Template for free here. We hope this post Npv Calculator Excel Template inspired you and help you what you are looking for.

Npv Calculator Excel Template was posted in September 20, 2022 at 3:31 pm. If you wanna have it as yours, please click the Pictures and you will go to click right mouse then Save Image As and Click Save and download the Npv Calculator Excel Template Picture.. Don’t forget to share this picture with others via Facebook, Twitter, Pinterest or other social medias! we do hope you'll get inspired by SampleTemplates123... Thanks again! If you have any DMCA issues on this post, please contact us!