Dupont Analysis Excel Template

Dupont Analysis Excel Template – The DuPont analysis (also known as the DuPont identity, the DuPont equation, the DuPont model, the strategic return model, or the DuPont method) is a three-part expression of return on equity (ROE) or return on investment (ROI).

Through ROE analysis, financial statement financial metrics allow analysts to understand the sources of superior (or inferior) returns relative to companies in a similar industry (or different industries). Also, the return on equity (ROE) ratio is a measure of shareholder profitability. Finally, the division of ROE into the various factors that influence a company’s performance is often referred to as the DuPont system.

Dupont Analysis Excel Template

Although it has had its positives and negatives for nearly 100 years, the DuPont model can provide business managers with insights to understand the underlying drivers of profitability. Therefore, it is an ideal tool for analyzing investment returns. For a detailed description of the DuPont analysis, see Wikipedia.

Amazon Full Analysis Using Dupont Analysis Excel Template

The DuPont model template contains 3 slides. Slide 1, Vertical Return on Equity (ROE) Model Analysis for Dupont Analysis

Slide 2 Vertical ROI (Return on Investment) Model Analysis Dupon Analysis Data Analysis Report Sample PPT tem… Enable JavaScript Data Analysis Report Sample PPT Templates Free Download

Size: 91K Type: PPTX Aspect Ratio: Standard 4:3 Click the blue button to download. 4:3 Download Template The DuPont method is an important analysis used to evaluate a company’s performance in detail. DuPont Corporation salesman Donaldson Brown discovered the DuPont equation in 1920. The DuPont analysis is an extension of return on equity (ROE) broken down into more detailed and complex equations. Many investors use ROE to find the right companies to invest in. You’ll also learn what ROE is and how to use the DuPont formula to give investors a more accurate analysis of a company.

Excel Financial Models Examples

An increase in share capital is a positive sign that indicates an increase in ROE. However, a higher ROE also means that the company has to take on more debt, thereby reducing equity. This can make the stock more risky. ROE numbers can be misleading, so you need to subtract the ratios to better analyze your data. Using ROE is not always an accurate predictor of company performance.

The three-step DuPont equation has an additional component to the ROE calculation compared to the original ROE equation. It measures three factors of a company: profitability, efficiency and leverage.

As mentioned above, ROE shows how profitable a company is compared to the amount of equity invested in the company. Return on assets (ROA) measures how much profit a company makes relative to its total assets.

Discounted Cash Flow (dcf) Valuation Excel Model (engineering And Construction)

The difference between ROE and ROA is the denominator. The reader’s “net gain” is the same for both. The denominator of ROE is equity, which equals assets minus liabilities. The denominator of ROA is total assets = equity + liabilities.

Looking at these two equations, you can see that ROA and ROE are actually equal to each other, especially when the company has zero debt. The ROE DuPont analytical equation should be used to determine the difference between ROE and ROA.

The image above shows that the first half of the ROE equation is ROA, since sales cancellation equals net income/assets. Leverage, also known as capital ratio, is the key difference between ROE and ROA. When a company takes on debt/leverage, it affects ROE because taking on debt increases the company’s assets. As liabilities increase, equity decreases and ROE increases. ROE and ROA are both important profitability ratios to consider when looking at a company’s performance.

Dupont Analysis Assignment

Instead of doing all the calculations, there are templates that make it easier for investors to use DuPont’s analysis.

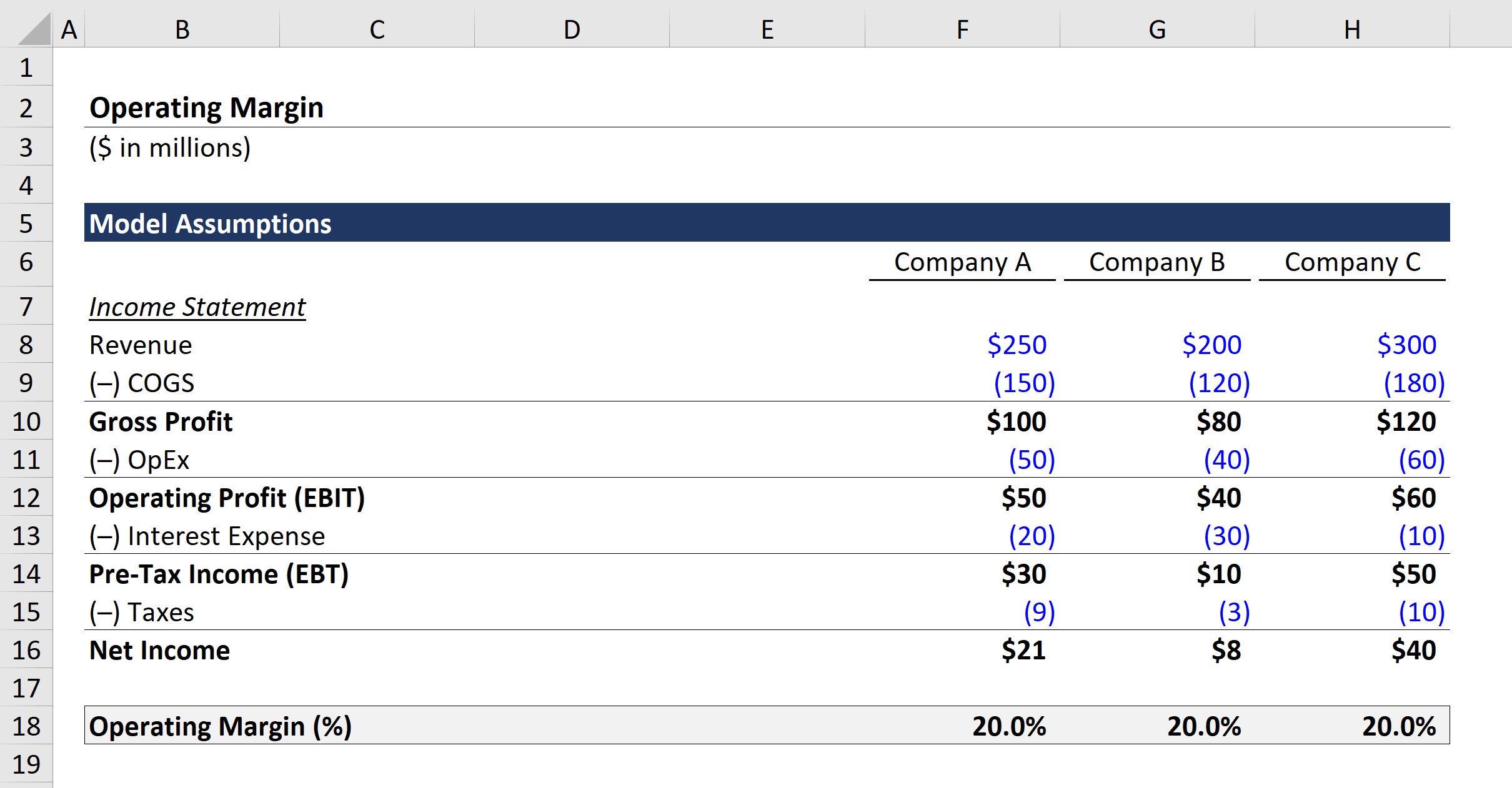

The table above is part of the DuPont template. Reduce your workload by calculating the ROE of all three factors. It can be used to compare ROE between different companies or different years.

Finally, we see that DuPont’s analysis is important to investors because it can show the complete picture. DuPont analysis shows you what is changing in your company and where exactly you are doing better or lagging behind. If a company is underperforming its competitors, it can reduce its net profit margin or reduce leverage, checking if it is costly. DuPont analysis is essential for a deeper understanding of the company’s financial position.

Financial Ratios Calculator Template

Nothing posted constitutes a recommendation that any particular security, portfolio of securities, trading or investment strategy is suitable for any particular individual.

The authors do not provide professional advice. Readers should consult a professional financial advisor to determine whether the strategies discussed here are appropriate.

The purpose of this article is to help users gather the information they need from various sources whose content is considered authoritative. Trademarks (if any) are the property of their respective owners and are not reproduced. All trademarks mentioned are the property of their respective owners. Other trademarks and trade names may be used in this document to refer to the entities claiming the trademarks and names or their products. disclaims any ownership interest in the trademarks and trade names other than its relationship with the trademark owner or trademark owner.

Global Financial Managaement Rivier University 1 2. 3

Real GDP Real Private Consumption Index Real Private Investment Real Government Expenditure Real Net Exports Real Exports Real Imports Federal Deposits Federal Expenditure Federal Surplus or Deficit Debt Real Private Investment Non-Residential Living Real Private Investment Housing Real Potential Gdp Real Personal Income Real Personal Expenditure RPCE Durable Goods RPCE RPCE Non-Housing RPCE Services Personal Savings Rate Currency currency money supply reserve money supply M150 money supply M2 INDICATORS INDEX ACTOR DEVICE ACTOR SERIES INDEX dollar sterling yuan US dollar Canadian dollar US dollar yen US dollar CpiCpi wo food energy Cpi food Cpi energyChain price index Chain price index wo Food energy Gdp Price DeflatorPpi Final demand Ppi Finished goods sPpi materialPpi crude index C Oil price 0 oil price PPi final demand 2 food price Coal use wo energy production Utilization of production capacity Inventories Sales retail food products Sales of vehicles light weight production e orders durable goodsManufacturing orders capital goodsLoansConsumer credit profitability gCompany profitsHome construction startBuilding permitsHouse constructionEmployees, non-agricultural workersEmployees private individualsEmployees production of goodsEmployee service provisionEmployee governmentUnemployment rateInitial climatesAverage number of weeks unemployedRecruiting Labor recruitmentTermination Labor outputPart time work

I’m so glad you’re here. My name is Ankur and I am the founder/manager of the company. Over the past four years, I’ve helped more than 2,500 clients implement their investment research strategies and tracking systems in Excel.

With our easy-to-use EXCEL feature, you can access over a billion available market data points on your EXCEL sheet. Get started now.

Stock Analysis Spreadsheet For U.s. Stocks: Free Download

Toll Brothers Inc. 52.14 USD 0.47 (0.91%)84 Position Optional: Yes Market Cap: 5,601 MIndustry: Home Construction52 Weekly Range 39.53 70.05 Columbia Sportswear Company USD 90.22 -1.21% (-1 .$3M: 8 Yes 0.3%:8) Industry: Apparel Manufacturing 52 States Coverage 65.02 101.64 Best Buy Co . Inc.81.51 USD -0.43 (-0.52%)83 Rank Optional: Sample Price Total: 17,792 MIndustry: Specialty Retail 52 Week Range 60.79 112.96 PulteGroup Inc.47.52 USD 82 Rank Optional: yes0Markett5:2 Range 35.03 58.09 Buckle Inc. . ()46.89 USD -0.12 (-0.26%)82 Rank Optional: Yes Market Cap: 2,269 MIndustry: Clothing Stores52 Weekly Range 26.504 . 7 Pilot8. Corporation Class B $77.72 -0.02 (-0.03%)81 Rank Optional: NoMarket Cap: 22, 167 M52 Basic Range 52.67 93.03 Lennar Corporation Class A $93.78 $0.17 (0.18%) 81 Grade Optional: YesMindus, Capries:8 26 Home Construction 52 weeks e 62.54 112.50 Evercore Inc. Class A $115.79 $1.52 (1.33%)81 Rank Optional: Total Supply: 4,351 M Industry: Capital Markets52 Weekly Range $78.67 142.18 CRA International Inc. $122.10 -1.85 (Marketable%) ( Marketable %) (Marketable %) (Marketable %) -7 : Business Services 52 Weeks 78.35 125.80 CNX Coal Stocks LP135.38 USD -0.84 (-0.62%)81 Available Ranking: Sample Value Total: 6,869 M Industry: All other business support services within 52 weeks 1208) 548 1208.548. Average Annual Growth Rate (CAGR) Growth Rate Growth Rate Average Monthly Annual Growth Rate (AAGR) Average Revenue Per User (ARPU) Internal Growth Rate (IGR) Sustainable Growth Rate (SGR) Reinvestment Rate Usage Rate Same Organic Growth Organic Growth Store Sales

Working Capital Net Working Capital (NWC) Negative Working Capital Cash Conversion Cycle Operating Cycle Working Capital Turnover Current Assets Net Operating Assets Current Working Capital (OWC) Average Payback Period Average Inventory Period Average Payroll Period

Activity Ratio Sales Open Days (DSO) Inventory Open Days (DIO) Inventory Sales Days (DSI) Days Payable (DPO) Asset Turnover Fixed Asset Turnover Inventory Turnover Receivables Turnover Purchases Turnover Stock Turnover Cash Turnover Debtor Days

Comparable Sector Analysis (using Excel Template)

Return on Equity (ROIC) Return on Assets (ROA) Return on Equity (ROE) DuPont Analysis Return on Equity (ROCE) Equity Ratio Return on Sales (ROS) Return on Net Assets (RONA) Return on Investment (ROI) % of Operating Profit

Liquidity Ratio Current Ratio Quick Ratio Acid Test Ratio Cash Ratio Cash Flow Adequacy Ratio Leverage Ratio Equity Ratio Protection Interval Ratio (DIR) Cash Days Asset Coverage Ratio

ScalePorter’s Five Forces Model Economics SWOT AnalysisEconomic MoatMarket ShareAverage Selling Price (ASP)Addressable Market (TAM)Switching CostsNetwork EffectNet Promoter Score (NPS)Annual RevenueGross RevenueFull Time Equivalent (FTE) Margin Margin Margin

Dupont Shift Schedule Excel

The DuPont analysis is a framework used to analyze the key components of return on equity (ROE) metrics to determine a company’s strengths and weaknesses.

Originally developed by Donaldson Brown at the chemical company DuPont Corporation in the 1920s, the model is used to analyze return on equity (ROE), which is divided into different parts to analyze the contribution of each part.

In the three-step DuPont analysis, the equation is multiplied by the company’s net profit margin, asset turnover ratio, and leverage

Dupont Schedule Template Worksheet Excel

Analysis excel template, bid analysis template excel, gap analysis excel template, dupont analysis excel, data analysis template excel, job safety analysis template excel, swot analysis template excel, dupont analysis calculator excel, dupont analysis template, cash flow analysis template excel, cost benefit analysis template excel, financial analysis excel template

Thank you for visiting Dupont Analysis Excel Template. There are a lot of beautiful templates out there, but it can be easy to feel like a lot of the best cost a ridiculous amount of money, require special design. And if at this time you are looking for information and ideas regarding the Dupont Analysis Excel Template then, you are in the perfect place. Get this Dupont Analysis Excel Template for free here. We hope this post Dupont Analysis Excel Template inspired you and help you what you are looking for.

Dupont Analysis Excel Template was posted in January 7, 2023 at 2:12 am. If you wanna have it as yours, please click the Pictures and you will go to click right mouse then Save Image As and Click Save and download the Dupont Analysis Excel Template Picture.. Don’t forget to share this picture with others via Facebook, Twitter, Pinterest or other social medias! we do hope you'll get inspired by SampleTemplates123... Thanks again! If you have any DMCA issues on this post, please contact us!