Australian Tax Invoice Template Excel

Australian Tax Invoice Template Excel – An invoice is a request for payment for a product or service that states the price and amount of each item. Invoices are usually paid upon receipt, although most companies allow up to 30 days for payment before late fees are charged.

An invoice is a document that is used as an invoice for goods or services. The party requesting payment (the seller) creates an invoice, covering their details, the customer’s details, a description of the goods or services provided, the total amount owed and the preferred payment method.

Australian Tax Invoice Template Excel

Upon completion, the invoice must be sent to the customer (buyer) electronically or by standard mail. For added invoice customization and a more formal presentation, include an invoice cover with the delivery.

Sole Trader Invoice Template

The oldest known human writing inscribed on a cuneiform stele is a 5,000-year-old receipt for the sale of clothing. The earliest recorded payment was in beer and recorded in the same cuneiform script.

Details Date: [X] Invoice Number: [X] From [Company Name] [Company Name] [Address] [Address] [Email] [Email] Status Amount X] Discount [X] VAT/Taxes [ X] Total [X] ] Observations _____________________________________________

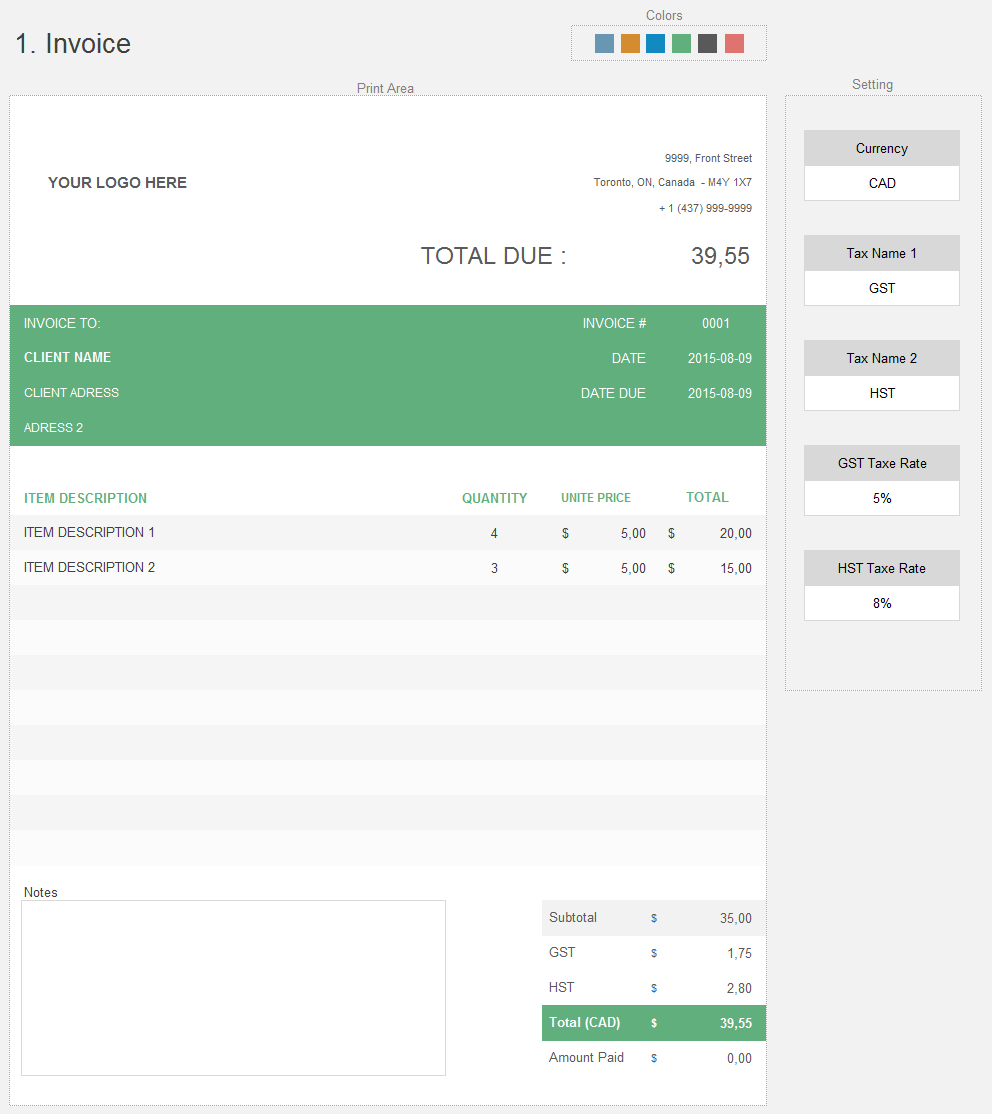

Upload a logo for your device to be placed on the invoice. It is better to use a square sized logo.

Invoice Template For Professionals

Select the More button and preview the invoice to check the final product before shipping. When you’re ready to send, select the Send button at the bottom of the page to email the invoice to the customer. You can also save the invoice and send a link. With one account, you can accept credit card, Venmo, and CashApp payments.

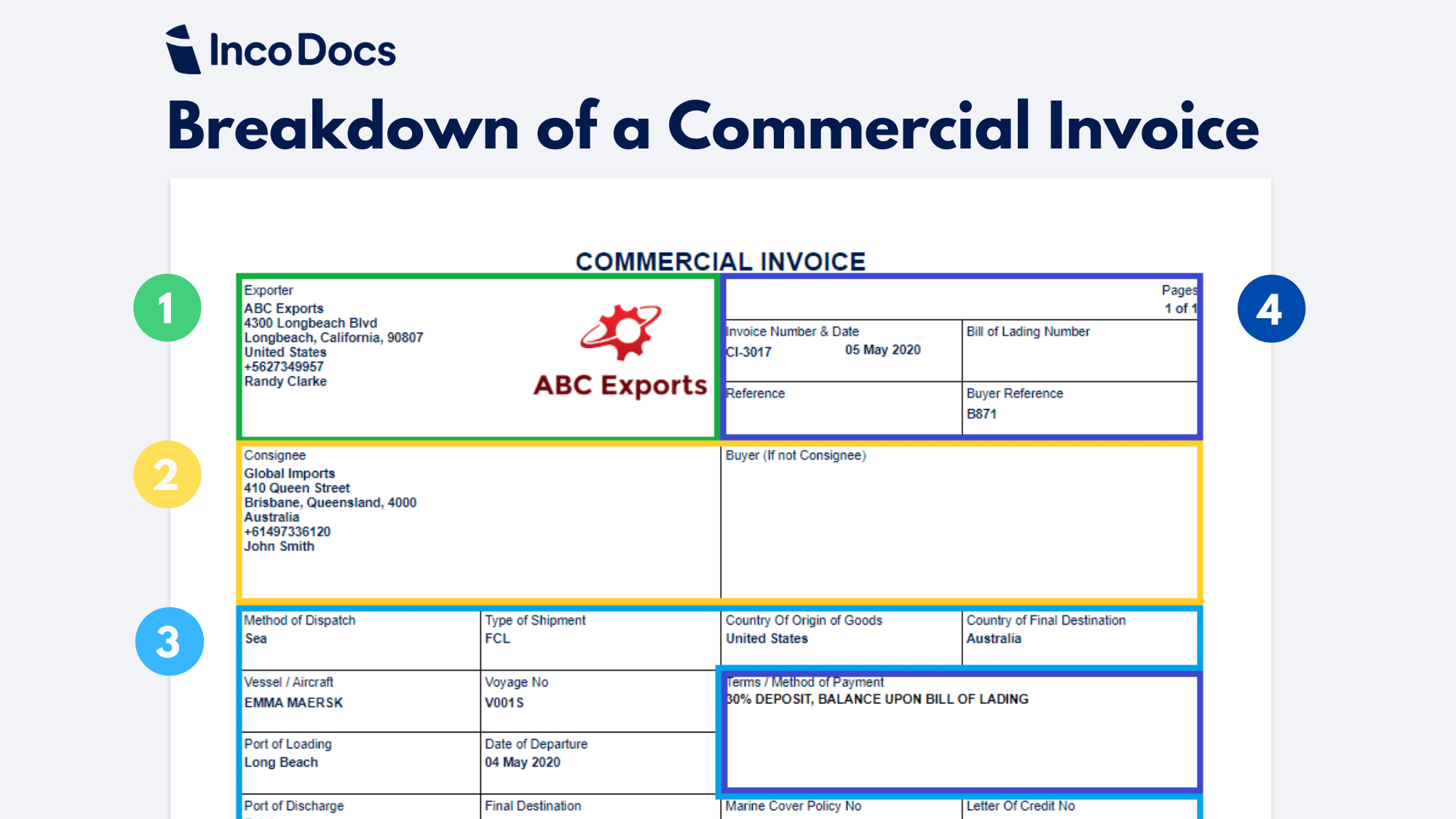

Invoices should be detailed enough to clearly convey everything the recipient needs to know, but simple enough to reduce confusion. Invoices must include certain fields to be legally retained. Invoices with all required fields can be easily created and customized using templates. Here are the ten basic components of a legal invoice:

As a general rule, US sellers must retain invoices for at least three (3) years. According to the US Internal Revenue Service (IRS), a person or business must retain an invoice if:

Excel Of Invoicing Management System.xlsx

Using an online invoice generator can protect you from having to disclose confidential information to customers and buyers. Invoice Maker takes your privacy very seriously and encrypts all your data so you never have to worry about it falling into the wrong hands.

The mark on the invoice is entirely up to you. You can customize color schemes and add your own logo in our super easy to use invoice generator. To remove the Invoice Maker flag, go to Settings and turn off this feature under Invoice Defaults.

When you click the Send button, your invoice will be sent to the email address included in the Bill To section. Alternatively, you can send your customer a link to the invoice in a separate email.

Abn Tax Invoice

Yes You can generate a PDF version of your invoice. It will provide a live link in the payment section, just like the web version.

Payment status is automatically updated in Invoice Maker. You can also open the invoice and select More to manually mark the invoice as paid, unpaid or voided.

Below are the maximum fines that can be charged if a bill is not paid. Any late fees must be written on the invoice when it is sent to the customer. Late fees are calculated by multiplying the total amount owed by the annual interest rate (%).

Excel Invoice Template

It cannot exceed 10% or 5 percentage points of the Fed rate; 10.5% if the loan is over $25,000.

Not to exceed the applicable rate (17%) as set forth in Section 3 of the 89th Amendment to the Arkansas Constitution.

7% for money, goods or things in action; 10% for money, goods or things used for personal, domestic or household purposes; or 10% or 5% + the prevailing rate established by the Federal Reserve Bank of San Francisco for any other purpose, whichever is greater.

Simple Excel Invoice Template

The maximum interest rate is 5% of the Fed discount rate. There is no interest rate cap on loans over $100,000.

18% unless the loan exceeds $500,000, in which case the rate may be 25% (per § 687.071(2))

Without a written contract, the maximum interest rate is 7%; 16% for loans of $3,000 or less; and for loans of $250,000 or more, the parties to the written agreement may set any interest rate.

Free Excel Invoice Templates

10% without written contract; 12% for consumer credit operations; 10% for recovery of judgment in any civil action.

5% without written contracts; for written agreements, 2 percentage points above the 10-year fixed-term average monthly rate on U.S. government bonds and notes.

Up to 10% if no other rate is agreed. Bonds, promissory notes, promissory notes or other written securities may stipulate up to 15%.

Automated Multi Invoice Collection » Extensions

The legal rate is 8%. If there is a written agreement, for loans of $15,000 or less, the interest rate may increase to more than 4 percent or 19 percent, whichever is less, above the Bank of America’s 90-day effective discount rate. Federal Reserve for commercial paper. Any interest rate is allowed on loans over $15,000.

Without a written contract, the maximum interest rate is 6%. The maximum interest rate on consumer credit sales is 30% on the first $1,000, 21% between $1,000 and $2,800, 15% on more than $2,800, and 18% on all outstanding balances.

Up to 6% unless agreed in writing, in which case the interest rate may be up to 8%.

Staffing Agency Invoice Template

The interest rate is 6%, unless a different rate is agreed in writing. The interest rate will not exceed 8%.

The maximum annual interest rate is 8%. The “Contract Rate” shall not exceed 10% or 5% of the Federal Reserve Bank’s effective 90-day discount rate for commercial paper, whichever is greater.

If there is a procedure, the interest rate cannot exceed 10%, unless the “market rate” is higher.

Free Professional Invoice Templates For Australia

The annual interest rate is 10%. The parties may agree in writing that the maximum rate be 15 percent or 6 percentage points above the prime rate established by the Federal Reserve System, whichever is greater.

The parties may agree to any fee in writing. Rates cannot exceed the preferred rates of Nevada’s largest banks without a written agreement.

The maximum interest rate without a contract is 6%. The maximum interest rate for written contracts is 16%.

Recipient Created Tax Invoice Template (free Download) — E Bas Accounts

The annual interest rate is 6%, unless CLS Bank of New York prescribes a different rate, in which case the statutory rate is 16%.

The maximum interest rate is 6%. The maximum contract rate is 5.5% higher than the current cost of funds, but not lower than 7%.

The parties may agree to any fee permitted by state law; otherwise 6% is the maximum rate without a written contract.

Editing And Printing Invoices

The interest rate may not exceed 21% or the alternative rate plus 9 percentage points of the national preferential rate, whichever is greater.

The legal rate is 6%. Interest rates may be up to 12% if both parties agree in writing.

The rate may not exceed 12 percent, or 4 percentage points, the coupon yield equivalent to the average coupon rate of 26-week Treasury bills.

Pharmacy Invoice Template

Services are taxed according to the country in which the service provider is located. In most countries, services are taxed with Value Added Tax (VAT). In the United States, only four (4) states tax general services:

It depends on the final destination of the product. For example, in the United States, about half of the states tax shipping costs as long as shipping costs are separate from the sale (see table below).

Sales tax must be paid if the seller pays the carrier. In other words, shipping costs are almost always taxable.

Free Invoice Template

Sales tax is calculated as a percentage of the item sold and is determined by where the sale occurs. Sales tax is administered by each state, county, and territory of the United States.

Value Added Tax (VAT) is based on the cost of goods or

Hvac invoice template excel, contractor invoice template excel, australian tax invoice template, canadian invoice template excel, labor invoice template excel, construction invoice template excel, blank invoice template excel, rent invoice template excel, tax invoice template excel, australian invoice template, excel invoice template, plumbing invoice template excel

Thank you for visiting Australian Tax Invoice Template Excel. There are a lot of beautiful templates out there, but it can be easy to feel like a lot of the best cost a ridiculous amount of money, require special design. And if at this time you are looking for information and ideas regarding the Australian Tax Invoice Template Excel then, you are in the perfect place. Get this Australian Tax Invoice Template Excel for free here. We hope this post Australian Tax Invoice Template Excel inspired you and help you what you are looking for.

Australian Tax Invoice Template Excel was posted in December 17, 2022 at 2:25 pm. If you wanna have it as yours, please click the Pictures and you will go to click right mouse then Save Image As and Click Save and download the Australian Tax Invoice Template Excel Picture.. Don’t forget to share this picture with others via Facebook, Twitter, Pinterest or other social medias! we do hope you'll get inspired by SampleTemplates123... Thanks again! If you have any DMCA issues on this post, please contact us!