Unsecured Loan Agreement Template Free

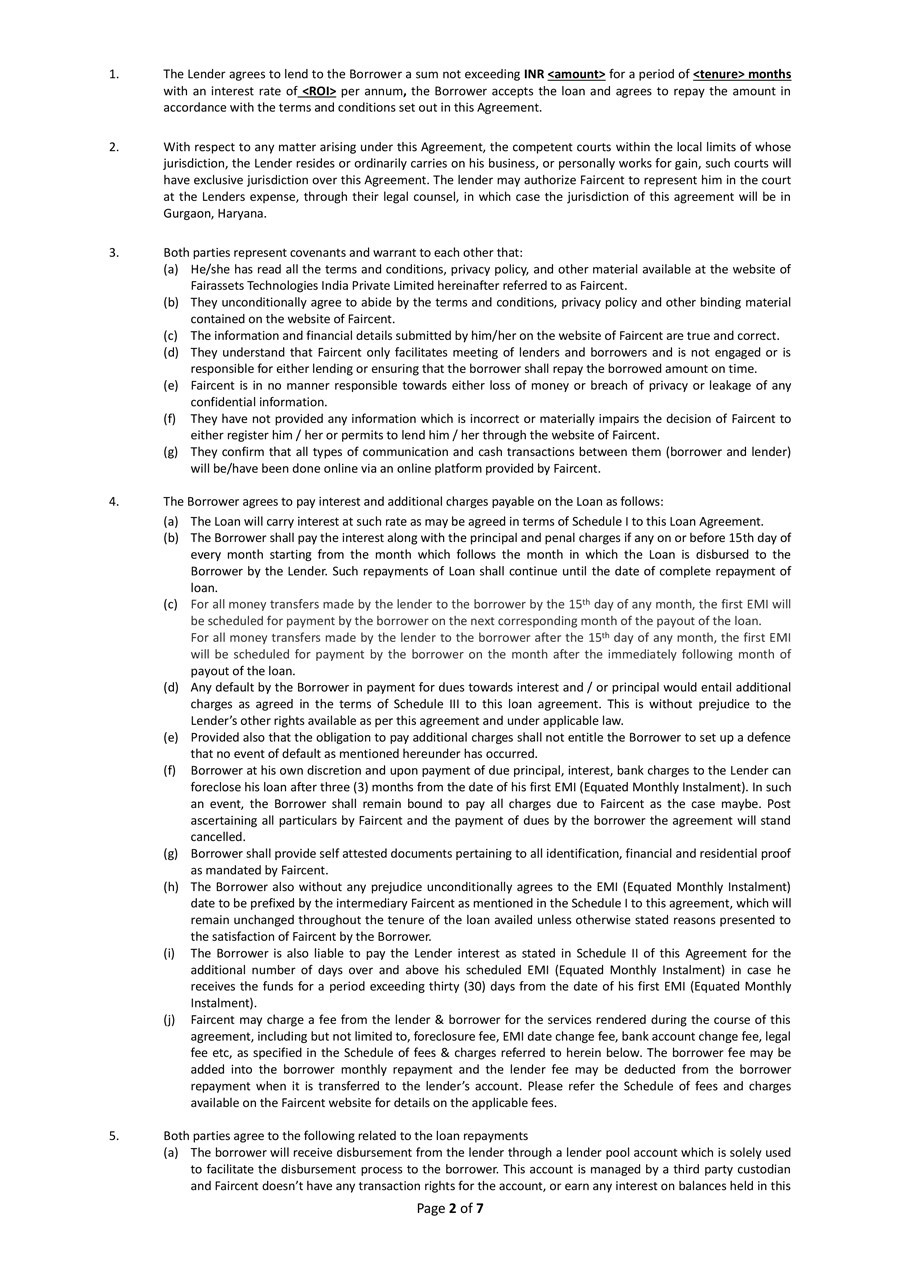

Unsecured Loan Agreement Template Free – A family loan agreement is entered into between a borrower who agrees to accept and repay a borrower related by blood or marriage.

The main goal is to make a simple agreement between family members. If interest is charged, the borrower cannot charge more than the government’s interest rate.

Unsecured Loan Agreement Template Free

Family loan agreements share the same basic elements as other loan agreements. Payment terms and payment schedules, interest rates and other contingencies should be defined, such as how late payments will be treated as defaults.

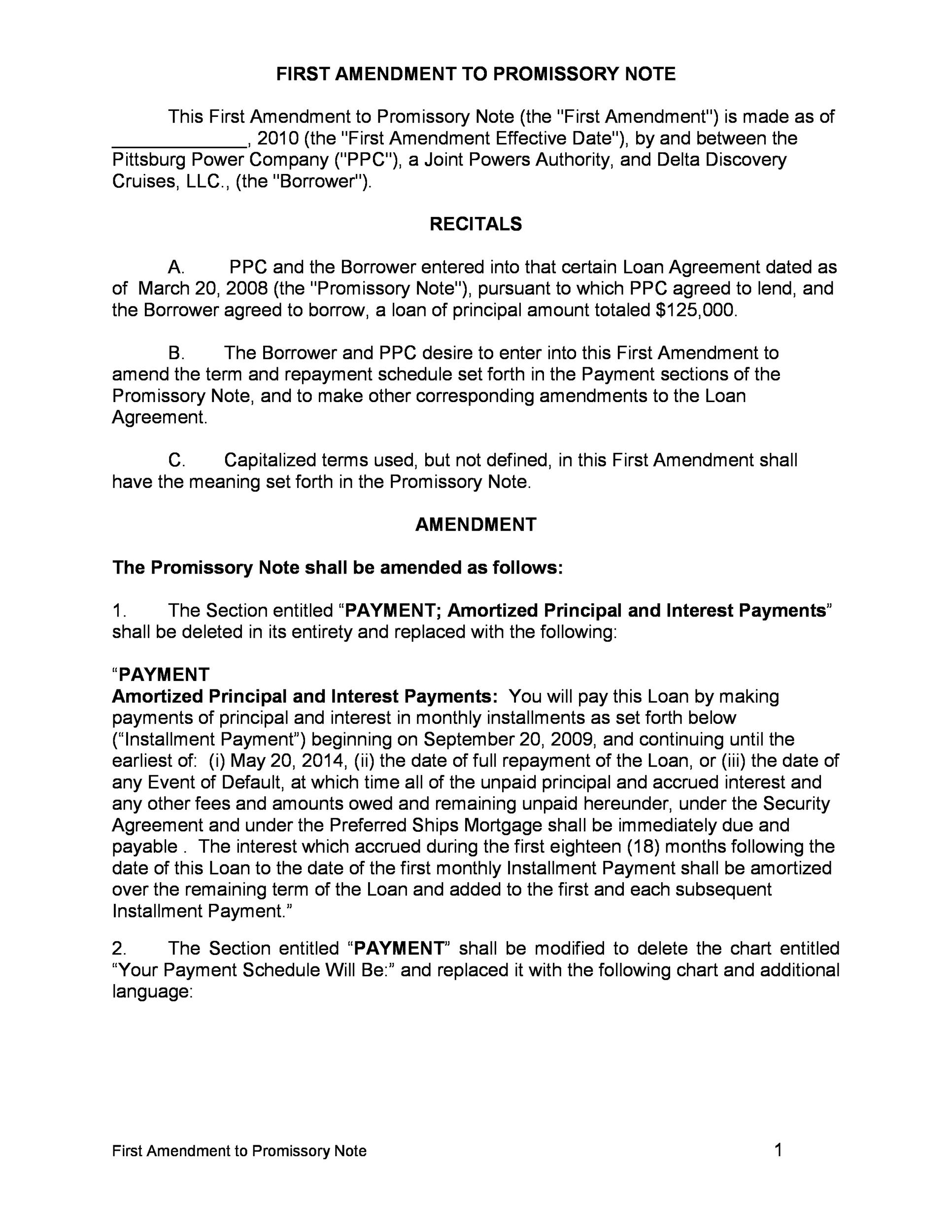

Free Loan Agreement Templates [word & Pdf] ᐅ Templatelab

Like all legal contracts, this contract must include the full names and addresses of both parties – and describe their relationship – and must be dated, signed and witnessed by at least two other witnesses. It is also recommended to check your contract.

It is advisable to pay attention to the details when lending money to the family. If family members don’t raise red flags after you ask these questions, the next thing to do is get your credit score and report. Considering that they are applying for a loan from a family member, it is suspected that the credit report may be low. Often, if you have money to burn, it’s better to donate the money or not at all. Borrowers in need, family members in this case, may default and face consequences. Use your intuition before you decide to give the loan.

If you decide to give a loan to a family member, there must be a detailed written agreement. The following are the most important aspects of the contract to conclude:

Free Commercial Lease Agreement Template

Sit in front of two witnesses at the conclusion of the contract. Try to find two witnesses who are not related. If there is a conflict, you don’t want the witnesses to clash. After all the signatures are signed, write a check to the lender or send an electronic transfer on the Internet. Don’t give money. For lenders, you want maximum security and that means that the money transfer is documented.

While there is clear wisdom in setting up a repayment schedule, the idea of taking out a loan from a relative clashes with the family dynamics that may have motivated the loan in the first place. Is there no family outside the sphere of the market, capitalism and profit?

First, there is the equity problem: by sending money to other people, the borrower eliminates the potential income. This is the cost of being able to make a loan. Interest payments compensate for this loss.

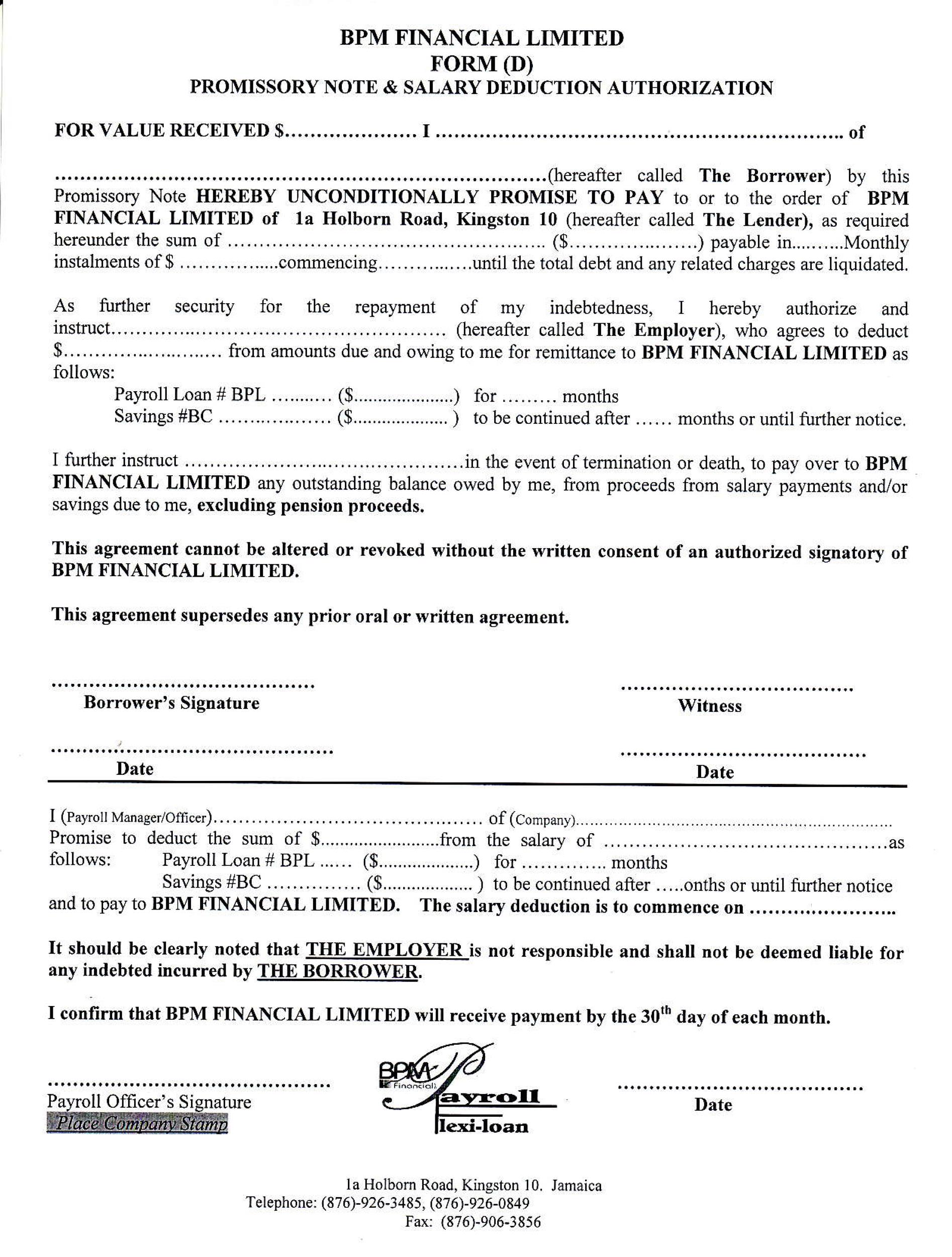

Personal Guarantee Form

How much income can you lose by borrowing from a family member? Although interest rates are currently near historic lows, the relatively risky stock market has produced great returns for investors large and small. What else? Investing in the stock market is usually less risky than giving credit to your son or nephew. Although you may not get back your lost investment income, interest charges are fair.

The bigger problem is related to taxes. If you take out an interest-free loan that exceeds the IRS donation limit — currently set at $14,000 — you’ll pay taxes. This is avoided by charging interest above the “Applicable Federal Rate” or AFR which is regulated by the government.

Although states also set statutory limits on the amount of interest that can be charged on loans, these limits against interest are irrelevant in most family situations.

Texas Loan Application And Personal Loan Agreement

Borrowers often turn to family after being rejected by conventional lenders. This means they are on shaky financial ground, with a combination of bad credit and insufficient income. Although family loans are often used for pragmatic purposes, and even constructive purposes – to finance education, consolidate credit, or to buy a first home – it is important to remember that avoiding the formal loan system is may exacerbate existing debt problems. Since family loans are often taken off the books of the official financial system, the regular repayment process does not build the borrower’s credit history as in the case of loans. official credit.

As a compromise solution, families can request the support of a third-party processor to facilitate repayment and report the results to the credit bureau. There are many competing online services, including the popular Loanback.com.

While formal lending can mean more scrutiny, borrowing from family doesn’t have to be easier. Often the choice to take out a family loan means trading some kind of difficulty for others. You don’t have to worry about hurting the bank’s feelings or alienating the loan officer – but the same can’t be said for family loans.

Free I Owe You (iou) Template

In general, the best way is to imitate the legal process, without administrative layers that can prolong and complicate the transaction with the bank. Although personal loans are the only option for bad credit loans, the ultimate goal is to repair the debt and finances to avoid personal loans. the official domain. While family finance can be a good solution for bridging the gap, it is unlikely to be the best long-term solution.

By using the website, you agree to our use of cookies to analyze website traffic and improve your experience on our website. The personal loan agreement defines the terms of how to borrow and when to repay. It is a simple contract that includes the amount borrowed, the interest and the period in which the money must be repaid. If the loan is not paid or the loan is not paid, they are not eligible for the agreement with the lender and are subject to late fees and penalties.

A personal loan is borrowed money that can be used for any purpose. The borrower is responsible for paying the borrower plus interest. Interest is the amount of the loan and is calculated annually.

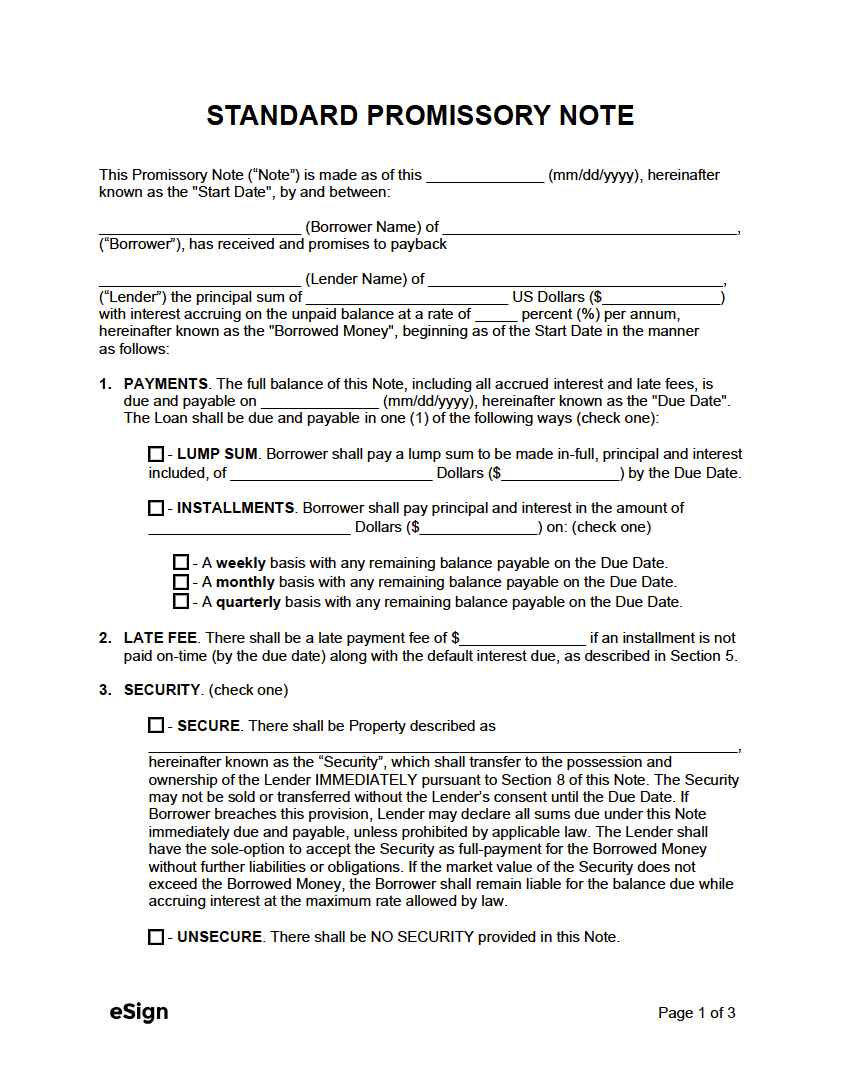

Free Loan Agreement Templates (samples)

Lenders can be banks, financial institutions or individuals – the loan agreement will be legally binding in both cases.

The main difference is that a personal loan must be repaid by a certain date and a line of credit offers revolving access to funds with no due date.

Unlike a business or car loan, the terms of which determine how the money will be spent, personal loan funds can be used for any purpose by the borrower.

Free Promissory Note For A Car

Because personal loans are cheaper, and are not tied to specific purchases or goals, they are often unsecured. This means that the loan is not tied to the actual property, unlike a home loan, or a car loan. If a personal loan is secured by insurance, it should be specifically stated in the contract.

Lender: [BORROWER NAME] has an email address of [ADDRESS] and agrees to lend money to the Borrower on the following terms:

2. loan amount. The total amount borrowed from the Lender to the Borrower is $ [AMOUNT] (“Borrowed Amount”).

Free Personal Loan Agreement Form

☐ – Interesting. The amount borrowed will bear interest at the rate of [#]% compounded: (check one)

☐ – DON’T be interested. There will be no interest associated with the amount borrowed. The Borrower’s only obligation to the Lender is to repay the principal amount.

4. TERMS. The total amount borrowed, including principal and interest, is due on [DATE] (“Due Date”).

Car Sale Contract With Payments

5. GIFTS. The Borrower agrees to repay the loan amount to the Lender according to the following payment schedule: (check one)

☐ – Weekly payment. The Borrower agrees to repay the Borrower by [DAY] every week until the due date.

☐ – Monthly payment. The Borrower agrees to repay the Borrower on [DAY] every month until the due date.

Free Payment (plan) Agreement Template

It’s called “Payment Schedule.” All payments made by the Borrower are applied first to accrued interest and second to the principal balance.

6. LATE PAYMENT. If the Borrower is more than [#] days late with any payment, it will be considered delinquent. If the payment is late, the Borrower will: (check one)

☐ – Late fees are charged. The Borrower will be charged a late fee equal to: [LATE FEES]

Free Memorandum Of Agreement Template (2021 Updated)

☐ – Security protection. The Borrower agrees to secure this Agreement by providing the following guarantees: [DESCRIBE] (“Security”).

In the event that the Borrower defaults on this agreement, the Borrower will assume the following: (check one)

☐ – Do not tighten the protection. This Agreement is not secured by any property or assets of the Borrower.

Free Auto Loan Agreement

8. Acceleration. The borrower has the right to declare the borrowed amount immediately due and payable, including interest, if one of the following cases occurs:

A.) Late payment. If the payment due under the payment schedule is delayed by more than 15 days;

C.) Security. If the property or assets pledged as security under this agreement are transferred or sold.

Free Payment Agreement Template

9. ARBITABILITY. If any provision of this Agreement or its application is, for any reason and in any respect, invalid or unenforceable, the remainder of this Agreement or the application of its provisions shall be invalid or unenforceable. other people,

Unsecured loan agreement template, agreement for unsecured loan, unsecured loan agreement format, unsecured personal loan agreement, money loan agreement template, unsecured loan contract template, unsecured personal loan agreement template, simple unsecured loan agreement, free download loan agreement template, free loan agreement template, unsecured loan template, standard loan agreement template

Thank you for visiting Unsecured Loan Agreement Template Free. There are a lot of beautiful templates out there, but it can be easy to feel like a lot of the best cost a ridiculous amount of money, require special design. And if at this time you are looking for information and ideas regarding the Unsecured Loan Agreement Template Free then, you are in the perfect place. Get this Unsecured Loan Agreement Template Free for free here. We hope this post Unsecured Loan Agreement Template Free inspired you and help you what you are looking for.

Unsecured Loan Agreement Template Free was posted in January 10, 2023 at 4:08 am. If you wanna have it as yours, please click the Pictures and you will go to click right mouse then Save Image As and Click Save and download the Unsecured Loan Agreement Template Free Picture.. Don’t forget to share this picture with others via Facebook, Twitter, Pinterest or other social medias! we do hope you'll get inspired by SampleTemplates123... Thanks again! If you have any DMCA issues on this post, please contact us!