Npv Irr Calculator Excel Template

Npv Irr Calculator Excel Template – Professional Excel spreadsheet for calculating NPV and IRR. Estimate monthly cash flow and availability. Ready for presentation. Dashboard with dynamic charts.

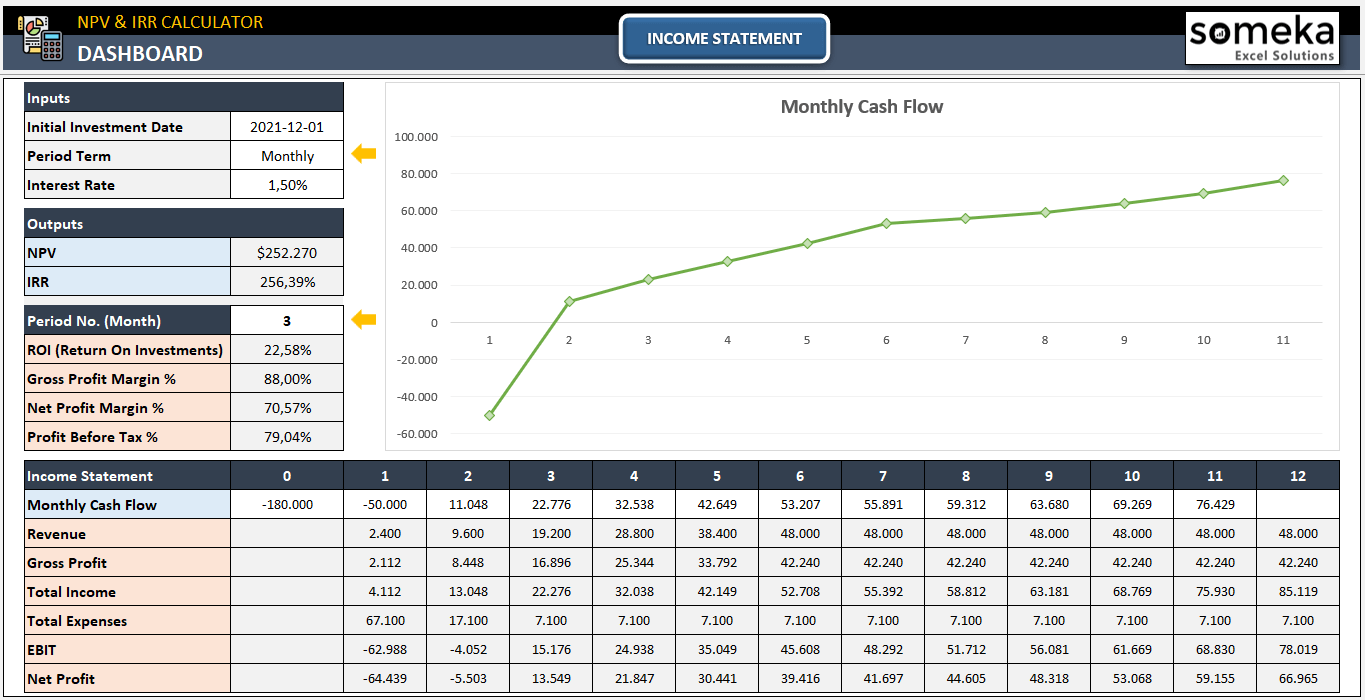

One of the methods of feasibility study is to check the NPV and IRR value of the project. When you enter your estimated cash flow NPV and IRR calculator Excel template shows you the project’s net present value and internal rate of return and more.

Npv Irr Calculator Excel Template

Net present value is an important indicator for determining present value after making assumptions about your income and expenses. Estimating your cash flow rate and net present value can be difficult. But they define the company you intend to set up. Also your business value and your project capital.

Internal Rate Of Return (irr)

A net present value calculation model is a tool for determining the difference between the present value of cash flows and the present value of cash flows over a period of time.

This Excel spreadsheet with NPV and IRR calculator collects data on estimated future cash flows by dividing them by discount rates to find the present value of each cash flow. The sum of all the present values of the cash flows forms the net present value formula.

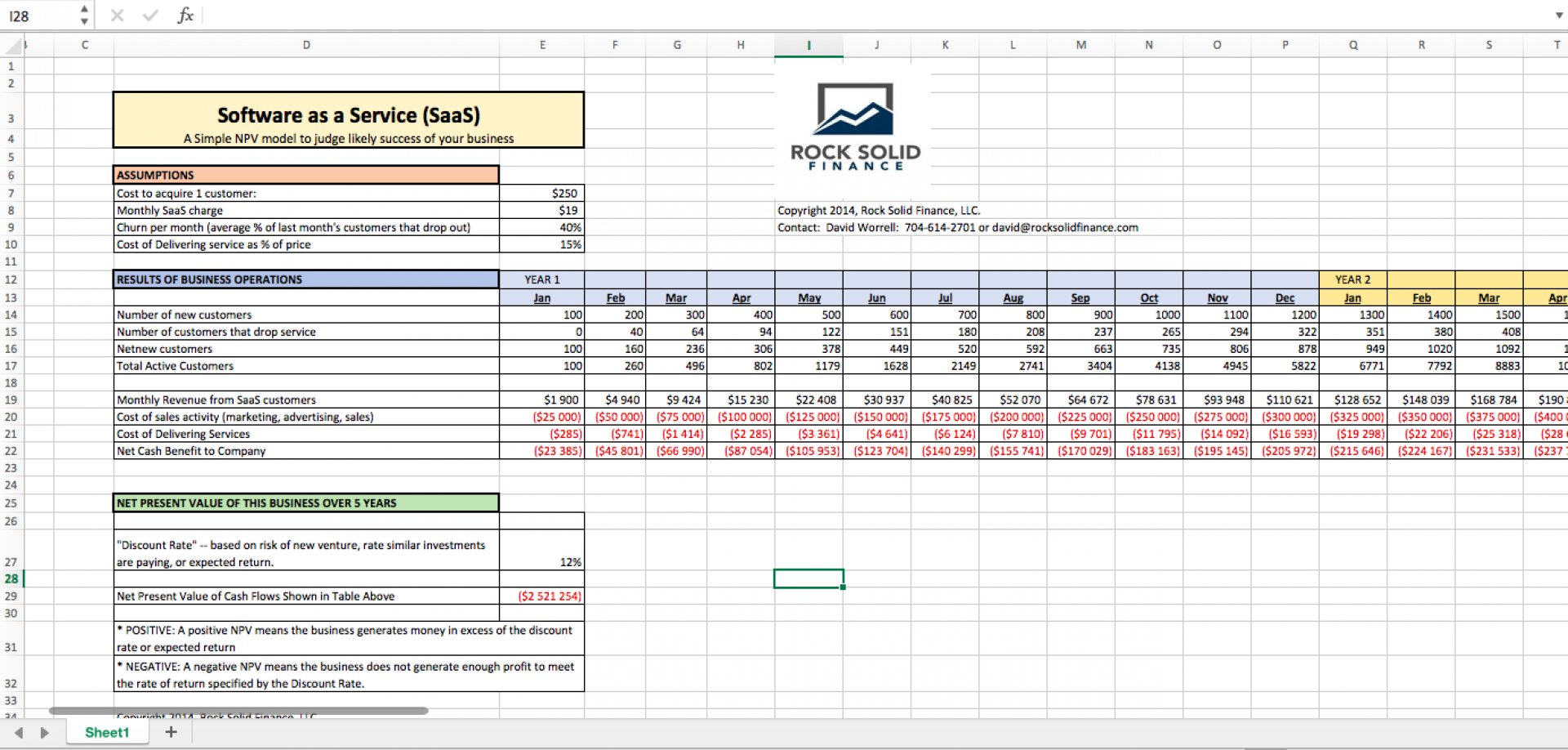

First, the dashboard of the NPV and IRR calculator templates is where you should type your data into the cash flow and input sections. Just enter your estimated cash flow in the cell. When you change the ‘duration’ on the dashboard, the ratio changes accordingly.

Di: Estimation Of Irr And Monte Carlo Simulation Of Npv By Excel

If you choose an annual period of time, the model will calculate the ROI as the net profit/initial investment for that period.

In a monthly period, ROI is calculated as Net Profit (Specific Month) / Initial Investment (Zero Period).

When the correct estimate is entered, it displays a line graph of cash flows and outflows, net present value, and internal rate of return.

Irr Internal Rate Of Return

Additionally, you can easily enter your estimated cash flow into the dashboard or use the income statement to calculate a well-estimated cash flow.

Feel free to check out our Cash Flow Models to help you find the right cash flow calculator.

Second, your earnings, total revenue, total income, total expenses, EBIT and net profit will be displayed on the dashboard section. In this NPV and IRR calculator Excel sheet, enter your data only in the white cells. Finally, the gray and colored cells will automatically display the results when you enter the desired cells.

Irr Levered Vs. Unlevered

NPV and IRR calculators are ready-to-use Excel models and are provided as-is. If you want to customize your report or need more complex templates, check out our personalized service.

Watch the video below to see examples in action! The presentation also includes usage notes, explanations and tips and tricks about the model. You can calculate return from just plain vanilla, commonly called ROI, but it’s just return on investment divided by cost. Instead of looking at the cash flow from your investment over time, the internal rate of return or IRR.

Thus, if you have a cash flow estimate for the investment alternative you are evaluating, the IRR will provide you with a side-by-side comparison of your investment. Even if the investments you’re comparing don’t always have the same cash flows, you can still calculate their rate of return as long as the cash flows are periodic (eg, quarterly or annually). . If the cash flows do not come at regular intervals, you can still use a similar function called XIRR.

Uneven Cash Flow Calculator » The Spreadsheet Page

Here’s everything you need to know about calculating internal investment rates with periodic cash flows. Regularly in Excel, Google Sheets, Numbers or other standard spreadsheet versions.

As with our other spreadsheet tutorials for finance, you can follow our spreadsheet program by hand to get extra practice and check your numbers while tracking, or you can download the included spreadsheet file and open it in Excel. Or open in another spreadsheet. Program for quick start.

Note that initial investment and cash flow are part of the same argument of the function.

Irr Calculator: 15 Years Google Sheet Model

Which is another good diagnostic tool. The IRR is the discount rate that brings the net present value of a stream of income to zero. Below I’ll show you how to use it to check the results (be sure to check out our tutorial on calculating net current values if you haven’t read it yet).

We will compare the two options to see which one is more profitable. We immediately see that other investments require an investment that is greater than 50%, the higher the return, and all of them pay off quickly, but not on a regular schedule.

It can show a negative numeric value. This is the worksheet’s cell-only interface, which rounds to several decimal places. Just ignore it.

Spreadsheets For Finance: Calculating Internal Rate Of Return

When you want to evaluate the quality of return on an investment over a period of time, especially if you want to compare the quality of many investments you can make, calculating the internal rate of return is a good idea. is a measuring instrument. When the returns will come at regular intervals, use the IRR function, and when the returns will come intermittently but at predictable intervals, use the XIRR function. These methods will allow you to meaningfully compare the investments you are considering.

Spreadsheets are a powerful tool to help you make your business and personal financial decisions. If you haven’t yet followed our previous spreadsheets for financial guidance, be sure to check them out:

Sign up below and we’ll send you a weekly summary of all the latest computer skills lessons. Don’t miss out on learning about the next big thing.

What Is The Irr Formula And Why It Matters For Real Estate Investments

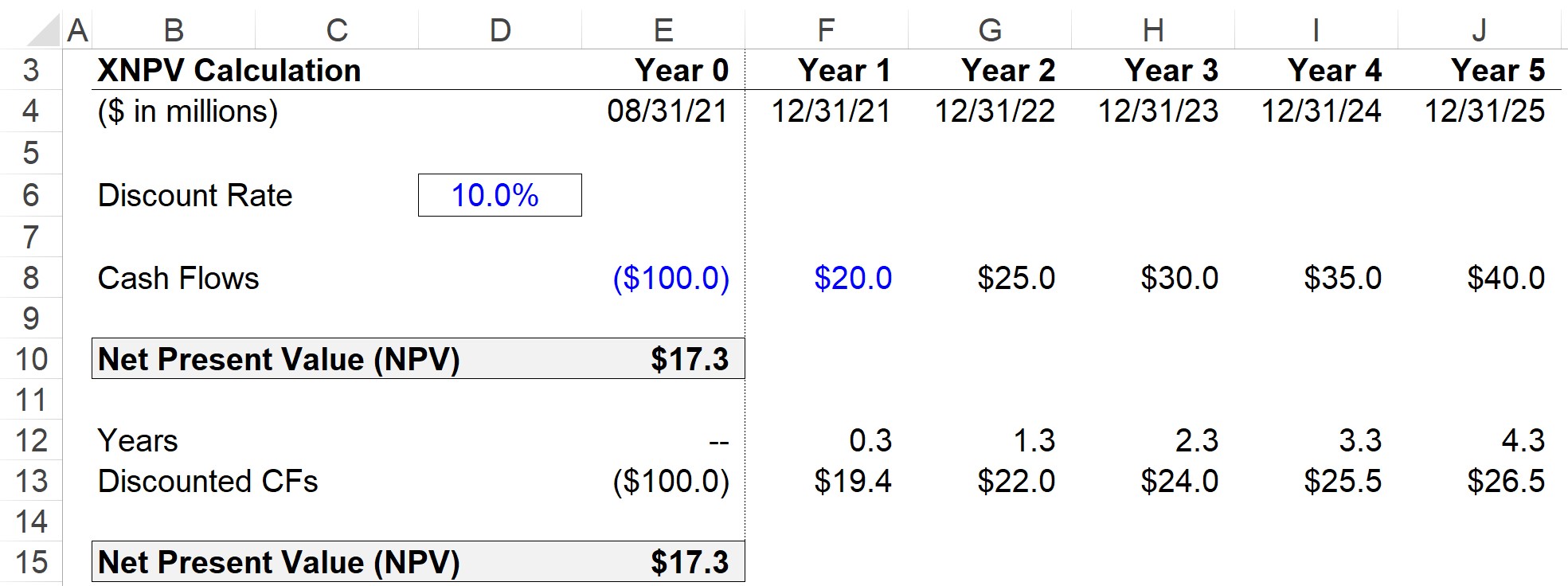

Bob Flesser has written numerous videos and books on Microsoft and Adobe products and has been a computer trainer since the 1980s. He is also a web and multimedia creator. Bob graduated from George Washington University with a degree in Economics and Finance. The DCF (discounted cash flow) model is largely based on the assumption that all growth rates and discount rates are known a priori by this DCF model, then we can estimate the internal rate of return. (IRR) means the discount rate, such as net present value NPV = 0.

(If you are familiar with this set of DCF models, you can skip this section to the Monte Carlo Simulation section.)

However, IRR cannot be solved by mathematical formulas, it can only be obtained by trial and error methods. Fortunately, Excel provides trial-and-error functionality, namely target searching. Figure 1 shows an example of a supermarket’s DCF, assuming the growth rate and inflation rate are fixed at 2% and 1%, respectively, and the lease is for 40 years, then the NPV depends on the discount rate. will be on We can use the top bar command: Data -> What If -> Find Target and set IRR as variable and NPV = 0 as target. It will then estimate the IRR as NPV = 0 if it can be estimated.

Is There A Quick Way To Calculate Irr In My Head?

In real life we rarely know the future growth rate and inflation rate. However, based on past data, we may be able to tell the difference between its standard and past average. Therefore, DCF should not be a descriptive model but a model.

Figure 2 shows panel A of the estimates of the growth rate and inflation rate based on normal distribution random functions. The Excel function is NORMINV(RAND (), Ave, SD). Then the estimated NPV is not a fixed value but will vary across scenarios. Figure 2 is just an example.

Because NPV estimates vary, it makes sense to question the distribution model of estimated NPVs if we can replicate the estimate thousands of times. Excel also provides a useful function (Data -> What if -> Datasheet) to repeat multiple simulations with each range as shown in Figure 3 showing each simulated NPV.

Free To Download

For investors, they may be interested in knowing the probability of loss, i.e., NPV < 0. After 10,000 iterations, we can count NPV < 0 and report the breakeven probability. Excel provides the COUNTIF function (data range "<0"). Due to different simulations, Figure 3 is only an example.

If we want to plot the joint distribution of simulated NPVs, we can use Excel’s Pivot Table function. Inserting a pivot table of the data range of simulated NPVs will simplify the table. Figure 4 shows an example, drag the data into the ROW and VALUE boxes in the right corner and right-clicking on any data will bring up a drop-down menu, GROUP allowing you to select the start and end values and interval. . The width top bar command for creating histograms also provides analysis for creating pivot charts. The distribution can then be drawn directly.

Monte Carlo simulation is a powerful tool for data analysis that can provide insight into real-life problems.

Xirr Vs Irr

Irr npv excel, npv irr calculator, npv irr excel template, irr calculator excel template, npv and irr calculator excel, npv template excel, irr calculator excel, npv and irr calculator, irr excel template, online irr npv calculator, npv calculator excel template, npv and irr excel

Thank you for visiting Npv Irr Calculator Excel Template. There are a lot of beautiful templates out there, but it can be easy to feel like a lot of the best cost a ridiculous amount of money, require special design. And if at this time you are looking for information and ideas regarding the Npv Irr Calculator Excel Template then, you are in the perfect place. Get this Npv Irr Calculator Excel Template for free here. We hope this post Npv Irr Calculator Excel Template inspired you and help you what you are looking for.

Npv Irr Calculator Excel Template was posted in January 18, 2023 at 6:14 pm. If you wanna have it as yours, please click the Pictures and you will go to click right mouse then Save Image As and Click Save and download the Npv Irr Calculator Excel Template Picture.. Don’t forget to share this picture with others via Facebook, Twitter, Pinterest or other social medias! we do hope you'll get inspired by SampleTemplates123... Thanks again! If you have any DMCA issues on this post, please contact us!