Personal Financial Planning Template

Personal Financial Planning Template – We all have goals in life – things like starting a business, buying a house, getting married – but financial problems often sneak in and prevent us from achieving these goals.

And so we wish we had made some money to plan to pay for the essentials and cover any unexpected life events… and still have enough left over to go to our goals.

Personal Financial Planning Template

If any of this sounds familiar to you, you probably don’t have a financial plan.

Personal Financial Plan Example Ppt Powerpoint Presentation Gallery Information Cpb

Most importantly, a financial plan helps you meet your current financial needs and provides advice for achieving future financial stability, enabling you to move forward with your goals.

In this post, you will learn everything you need to know about financial planning. We’ll also share eight steps to help you create your own financial plan, as well as some templates that can help you save money on time.

It takes into account your financial situation and goals, then creates a detailed plan based on your preferred goals, telling you exactly where to spend your money and time to save.

Google Sheets Monthly Budget Templates

Additionally, financial plans help you prepare for the unexpected by setting aside a pot of cash. In case of unexpected job loss, illness or economic downturn, you can rely on this money to meet your daily expenses.

Basically, you can use a financial plan to take control of your money so that you can achieve your goals and reduce the stress you have about your health.

In the past, people had to hire a professional to create a financial plan for them. But with the advancement in technology, you can build it yourself.

Free Budget Sheet Template

It’s very easy with a financial plan template, which you can create based on your goals, cash flow, etc. It can change the display. You will find some useful templates later in the article that you can use.

A personal financial plan is a written analysis of your finances, including your income, debts, assets and expenses.

Its purpose is to help you assess the feasibility of your goals and understand what steps you need to take – financially – to achieve them.

Financial Goals Worksheet To Rock Your Money

Your personal financial plan can take weeks, months, or years depending on the time frame it takes to achieve your goals. And you can always edit it to show new features or change values.

Making a financial plan will give you more confidence in your money flow. Plus, it means less late nights worrying about those pesky bills.

The problem is that many don’t know where to start. “How much does a financial plan cost?” They worry about things like this. And imagine that they need constant professional help.

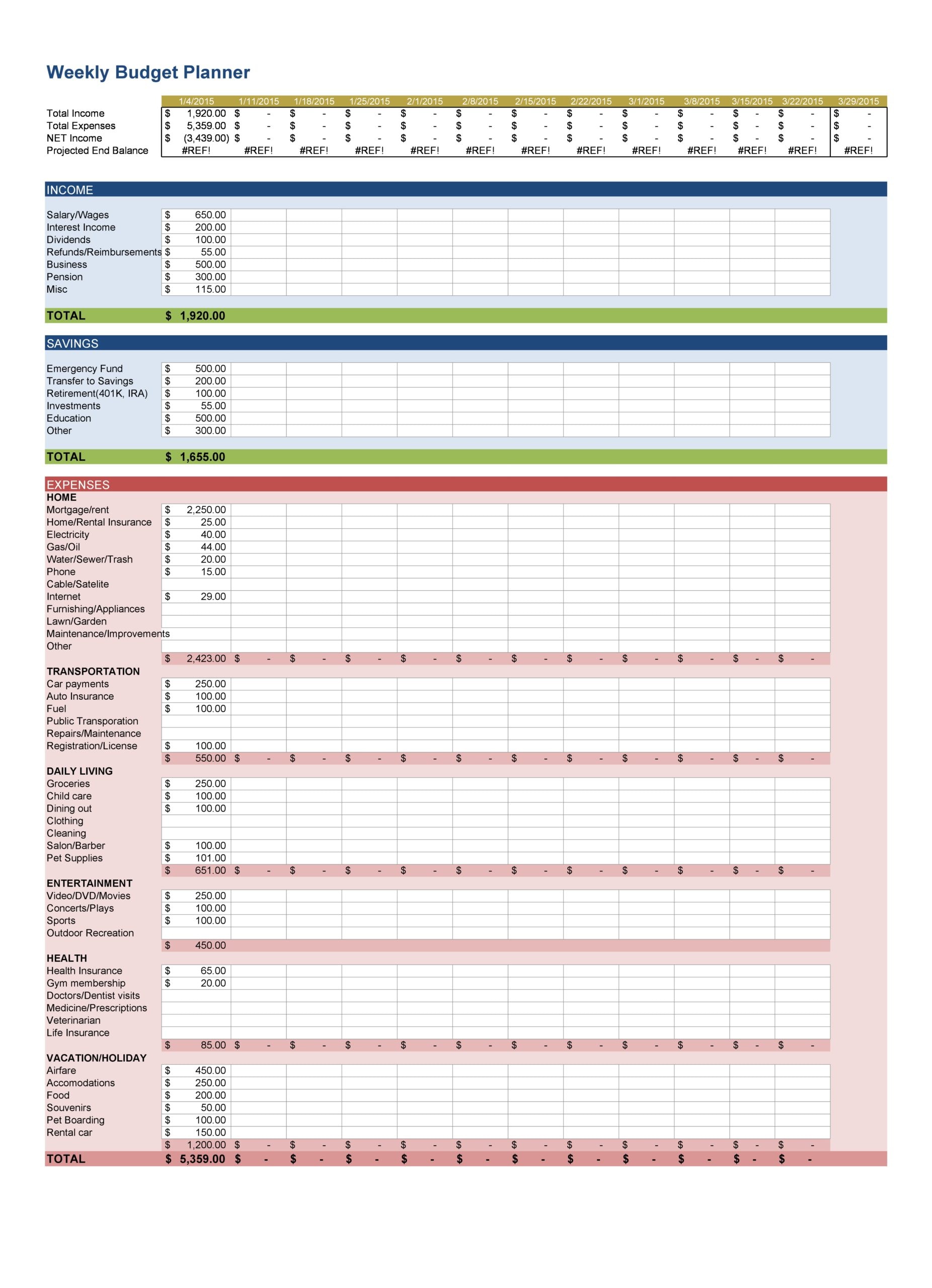

Free Weekly Budget Templates [excel, Word]

Good news? It’s never too late (or too early) to work on your financial plan. Even better – creating a financial plan is not as difficult as you think. You can also break it down into 8 easy steps, such as:

Before starting the actual “planning” part of the process, it’s important to know where your journey will begin. So check how your current financial situation is.

Honestly, everyone can benefit from investing in checking accounts, but it’s easy to avoid looking at bank statements.

How I Built A Finance Tracker Tool In Notion (with Template)

Think about it – when was the last time you looked at all your gas, electricity, broadband and Netflix bills and saw how much they add up?

Take your last 6 to 12 months of bank statements and highlight each regular expense in one color, then highlight your rare expenses in another color.

It can be useful to divide this money into personal and “big” money. When you have all the information in front of you, ask yourself:

Updated Financial Planning Spreadsheets Action Economics

The next step is to know where you are going. This is an important part of your “Financial Planning for Dummies” journey.

Setting concrete goals gives you direction and clarity when making decisions about your finances. Your goals will show you if you are moving in the right direction.

Don’t say that you need more money in your savings. Write a statement that describes exactly what you want to achieve, such as:

Free Money Management Template For Excel

Short-term financial goals, such as “I will put $100 into my savings next month,” keep you motivated by showing continued progress. Long-term goals give you a consistent direction to move forward.

No one likes to think about debt – but these are issues you can’t ignore if you want to be financially savvy. A personal financial plan can help.

If your interest and payments are overwhelming you, you are not making much progress with your short-term and long-term goals. So first figure out how to pay off what you owe.

Financial Therapy Templates

Start by creating a plan to eliminate your most difficult debts. These are the most expensive funds due to high interest rates and fees. Get rid of it as soon as possible.

If you’re having trouble settling multiple loans at once, it can be helpful to see if you can consolidate them into one, cheaper loan.

The bottom line is that you need to take action and start working to become debt free. Remember, debt covers everything from past problems like credit cards to long-term expenses like student loans.

Template For Personal Financial Statement

No matter how “prepared” you think you are, there is always a chance that some unexpected expense will come along and knock you off your feet.

Emergency funds protect you against things like an unexpected illness, a sudden job loss, or a bill you forget to pay.

Although the exact emergency fund you have is up to you, it should cover 3 to 6 months of your fixed income. You can also save enough for various expenses like entertainment and food.

Personal Financial Statement

Emergency funds help anyone. However, they are especially important if you are a freelancer, someone with a bad credit score or different finances.

Estate planning is one of those complicated terms that most people overlook – thinking it only applies to the wealthy or those nearing retirement.

However, you should think about protecting your family in your absence. The right scholarship program gives you peace of mind.

Top Excel Budget Templates

House planning might not be the best thing to do on a Friday night in terms of fun, but it will make sure you’re safe for anything.

The next step is to build on the wealth you already have, so you are prepared for the future. You can check on your savings and investments.

You may have different plans for your short-term and long-term goals. For example, your short-term financial plan may cover the steps you are taking now to build wealth. Your five-year financial plan can address things like retirement.

Free Personal Financial Plan Template

Investing for retirement is the best way to ensure you are prepared for the future. When you start planning for retirement, you need to consider some variables such as:

If you are new to investing, seek some support. There are financial advisors who can introduce you to different types of investment accounts and vehicles.

Just like an emergency fund protects you from unexpected life events, insurance protects your money from any unexpected disaster.

:max_bytes(150000):strip_icc()/how-to-figure-out-budget-percentages-for-money-goals-4171689_color2-ff413b51a2a44b138ce23775e25f4b66.png?strip=all)

The 10 Best Notion Finance Tracker & Budget Templates

Having the right insurance means you don’t have to break your bank every time something goes wrong. For example, home insurance means you are well protected against things like natural disasters and burglary.

Car insurance ensures that if something goes wrong with your car, you’re ready to jump in and fix the problem – without paying a fortune.

Having an emergency fund and making sure you’re adequately protected means you can stay on top of all your savings goals – even when the going gets tough.

Personal Budget Template Excel Sheet

The more you know about your current financial situation and where you are going, the more confident you will be about spending money.

However, finding a financial plan template and creating your own plan is just the first step of the journey. You also need to commit to actively tracking your progress.

Check in every three months and make sure you are moving in the right direction. A lot can change in your financial situation in a few weeks.

Free Financial Planning Templates

Remember to adjust your schedule when important events happen in your life again. Having a baby, getting married, or buying a new house all give you new ideas to deal with.

Carefully analyzing and adjusting your plan means you can enjoy a bullet-proof strategy for achieving your financial goals.

There are several financial plan template options available to help you set up a financial plan. You just need to enter the information in their fields. You can edit or remove fields based on the information you have.

Personal Financial Statement Templates & Forms ᐅ Templatelab

Even if you don’t want to use templates, these financial plan examples are a good place to start learning what general plans look like and the specific financials you’ll need to include in the document.

Use it to assess your current financial situation, create a plan to achieve your goals, and use a plan to track progress.

Only the Stasi financial planner allows you to set them aside – month by month

Long Term Personal Financial Plan: An Excel Template

Personal financial planning app, personal financial planning certificate, personal financial planning excel, personal financial planning services, personal financial planning excel template, online personal financial planning, personal financial planning software, personal financial planning jobs, personal financial planning template free, financial planning agreement template, personal capital financial planning, personal financial planning

Thank you for visiting Personal Financial Planning Template. There are a lot of beautiful templates out there, but it can be easy to feel like a lot of the best cost a ridiculous amount of money, require special design. And if at this time you are looking for information and ideas regarding the Personal Financial Planning Template then, you are in the perfect place. Get this Personal Financial Planning Template for free here. We hope this post Personal Financial Planning Template inspired you and help you what you are looking for.

Personal Financial Planning Template was posted in December 22, 2022 at 10:58 pm. If you wanna have it as yours, please click the Pictures and you will go to click right mouse then Save Image As and Click Save and download the Personal Financial Planning Template Picture.. Don’t forget to share this picture with others via Facebook, Twitter, Pinterest or other social medias! we do hope you'll get inspired by SampleTemplates123... Thanks again! If you have any DMCA issues on this post, please contact us!