Triple Net Lease Agreement Template

Triple Net Lease Agreement Template – If you own commercial real estate, a triple net lease (also known as a “net-net-net lease” or “NNN lease”) is a way to ensure that your tenant gets the most from owning and managing the property. It covers them all. Associated costs. Each “net” refers to a different type of expense, which typically includes property taxes, insurance, repairs, maintenance, utilities, and more. Commonly used for free-standing commercial buildings, this agreement can also be used for single-family residential rental real estate. When you’re ready, you can click the “Create Document” button to take a closer look at our sample triple net lease.

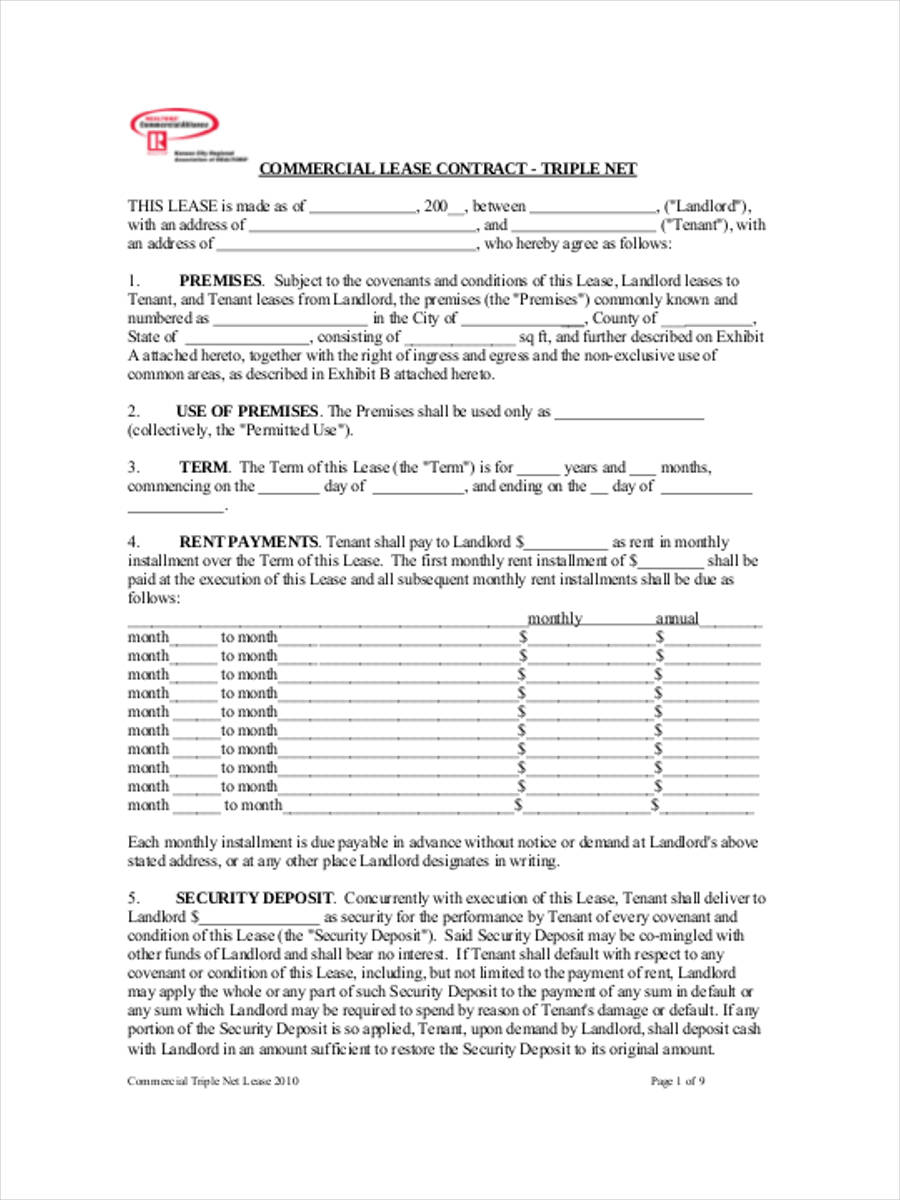

This lease agreement (this “Lease”) is dated between (“Landlord”) and (“Tenant”). The parties agree as follows.

Triple Net Lease Agreement Template

Yard Landlord leases to Tenant the premises located at (the “Premises”) in consideration of the rental payments set forth in this Lease.

Free Washington Lease Agreement (multi Tenant Triple Net(nnn)lease) Form

Duration. The lease period begins and ends. It is understood that both parties must give the other thirty (30) days written notice of their intention to vacate the premises. It must expire at the end of the calendar month. After the tenant leaves the house, he agrees to return the house in good condition and in a “clean” condition as on the date of commencement of the contract, which is accepted by the representative appointed by the landlord.

Triple net rent. This lease is commonly referred to as a “triple net lease” and it is the intention of the parties that the lessee shall not have any liability of any kind or nature to maintain, repair, improve, alter or use in any way. Expenses, rent and other charges incurred on the Property shall be free from encumbrance, cost or adjustment of any kind or nature on behalf of Tenant or Landlord under this Agreement. All such costs, charges and taxes, including, without limitation, any taxes, charges or fees payable by Tenant in accordance with the provisions hereof in connection with the ownership, maintenance, repair and operation of the Property.

Tenant shall pay for all water, gas, heat, electricity, lighting, telephone and other utilities and services provided on the Premises, as well as any taxes and real estate taxes, all accident and earthquake insurance and reasonable maintenance of the common area. expenses. If such service is not provided separately to Tenant, Tenant shall pay Landlord’s fair and proportionate share of all charges measured jointly with other premises.

Ohio Commercial Triple Net Lease Agreement

Lease payments. The rent paid by the tenant to the landlord in , the address may be changed from time to time by the landlord.

Estimated payment. Tenant shall notify Landlord from time to time of estimated charges for taxes, insurance, landscaping and parking lot maintenance, landscaping and parking facilities and services. The estimated payment shall be paid by the tenant on the 1st of each month including rent. The estimated fee may be increased or decreased by Landlord upon written notice to Tenant based on statements or penalties received by Landlord, the probable cost of the fees and expenses, or information that may increase. The landlord’s reasonable estimate of the expected payment or cost. The lessor has the right to keep the money received from such payments in the general fund pending all costs and payments. Actual Expenses shall be determined by Landlord not more than once in each calendar quarter and Tenant shall remit to Landlord upon request his unpaid portion of Actual Expenses. If Tenant has paid more than the actual expenses for such period, Landlord shall apply such excess payment to Tenant’s subsequent payments to Tenant. Upon termination of this Lease, such fees and charges shall be credited to the most recent accounting period, and Tenant shall pay the remaining balance to Landlord.

Possession. Tenant shall be entitled to possession on the first date of termination of this Lease, and shall deliver possession to Landlord on the last date of this Lease, unless otherwise agreed by both parties. At the end of the lease, the tenant will remove the property and possessions and hand them over to the landlord in good condition except for normal wear and tear.

Free 39+ Sample Lease Forms In Pdf

Change. The Tenant’s covenants and all work done by the Tenant or changes to the property must fully comply with all laws, regulations, orders, regulations, directives, codes, regulations and requirements of all government agencies, offices and requirements. Departments, Bureaus and Boards having jurisdiction over the property. Tenant shall give Landlord at least two days’ notice prior to delivering any building materials or beginning any improvements to the Property and shall reasonably cooperate with Landlord by posting a non-liability notice.

The price of change. Tenant shall pay all costs of construction, including costs of remodeling approved by Landlord, including the costs of architects, engineers, general contractors, subcontractors and labor and materials. Registration in this name on the property.

The following facilities are provided: Parking. The tenant has the right to use the parking space for parking the motor vehicles of the customers/guests.

Standard Industrial Lease

Property insurance. Tenant shall maintain casualty property insurance on the Premises and against loss or damage by fire and lightning and loss or damage caused by other perils to the extent less than Landlord named as additional insurance in such policies. The Tenant shall provide the Landlord with appropriate evidence to the Landlord’s reasonable satisfaction that it has been adequately insured by the Companies. Landlord shall receive advance written notice from the insurer prior to termination of such insurance policies. All insurance proceeds payable upon occurrence of any covered damages shall be paid to Landlord. Personal property or commercial property.

Tenant shall maintain any other insurance on the Premises that Landlord may reasonably require to protect Landlord’s interests. The tenant is responsible for maintaining accident insurance on their property.

At least throughout. Personal injury limits for at least one person injured, and for any accident, and at least one person for property damage. Lease payment by

Triple Net Vs. Gross Vs. Modified Gross Leases [pros & Cons]

Maintenance. It is the lessee’s responsibility to maintain the premises in good condition throughout the term of this lease.

Facilities and services. The tenant is responsible for all utilities and services related to the premises.

Tenant acknowledges that Landlord has fully explained to Tenant the cost of utilities, fees and services that Tenant is expected to pay to Landlord other than (if any) paid directly to a third party supplier.

Free Arizona Commercial Lease Agreement Template

Real estate tax. Tenant shall pay all real estate taxes and assessments assessed on the Premises during the term of this Lease. “Real Estate Tax” means any assessment, license, fee, rent, tax, levy, penalty or tax, directly or indirectly, imposed by any authority, including any improvement district, in any legal or equitable interest of the Landlord or the Tenant against the Landlord’s act of conveyance of the Real Estate to the Landlord. The estate tax share must be proportionate to cover only the period in the fiscal year that can be taxed against or taxed. Premises, and payable annually, for the term of this Lease, shall include the amount of such annual payments (for any partial year of the same amount) and the interest payable. As of the date of the execution of this Lease, no assessment or improvement districts affecting the addition shall affect the Premises as of the date of this Lease, so far as Landlord is aware of such annual real estate tax calculations.

Personal tax. Tenant shall pay all applicable taxes and other charges applicable to the Premises and the use of the Premises, as well as all sales and/or tax (if applicable). To be paid in respect , pursuant to which Tenant shall pay all taxes, whether or not attached to the Real Property, of Tenant’s furniture, improvements, furniture, fixtures, fittings and personal property prior to the destruction thereof. If the tenant in good faith disputes the validity of such personal property tax, the tenant must.

Commercial triple net lease template, triple net lease template, triple net lease agreement, free triple net lease agreement, triple net lease agreement pdf, triple net commercial lease agreement, triple net lease agreement example, free triple net lease template, what is a triple net lease agreement, sample triple net lease agreement, commercial triple net lease agreement template free, simple triple net lease template

Thank you for visiting Triple Net Lease Agreement Template. There are a lot of beautiful templates out there, but it can be easy to feel like a lot of the best cost a ridiculous amount of money, require special design. And if at this time you are looking for information and ideas regarding the Triple Net Lease Agreement Template then, you are in the perfect place. Get this Triple Net Lease Agreement Template for free here. We hope this post Triple Net Lease Agreement Template inspired you and help you what you are looking for.

Triple Net Lease Agreement Template was posted in December 26, 2022 at 5:54 pm. If you wanna have it as yours, please click the Pictures and you will go to click right mouse then Save Image As and Click Save and download the Triple Net Lease Agreement Template Picture.. Don’t forget to share this picture with others via Facebook, Twitter, Pinterest or other social medias! we do hope you'll get inspired by SampleTemplates123... Thanks again! If you have any DMCA issues on this post, please contact us!