Expenses Form Template

Expenses Form Template – Click for more information Click for more information Click for more information Click for more information Click for more information

Most of us know that when we go on a business trip, we save all our expenses – food, gas, dinners with clients, dry cleaning and entertainment – for reimbursement. .

Expenses Form Template

But we returned home. We let go of the pile of winnings we’ve collected and try to bring order to the chaos. We pull out a book and start sorting through the receipts, noting down the details to justify every dollar. Through the fog of time, we try to remember the details of Tuesday’s dinner. “Why is this food so expensive?” Am I just hungry or did I take a client? If it’s a customer, who is it? The manager will want to know that sales can follow. Argh! I should have taken better notes.

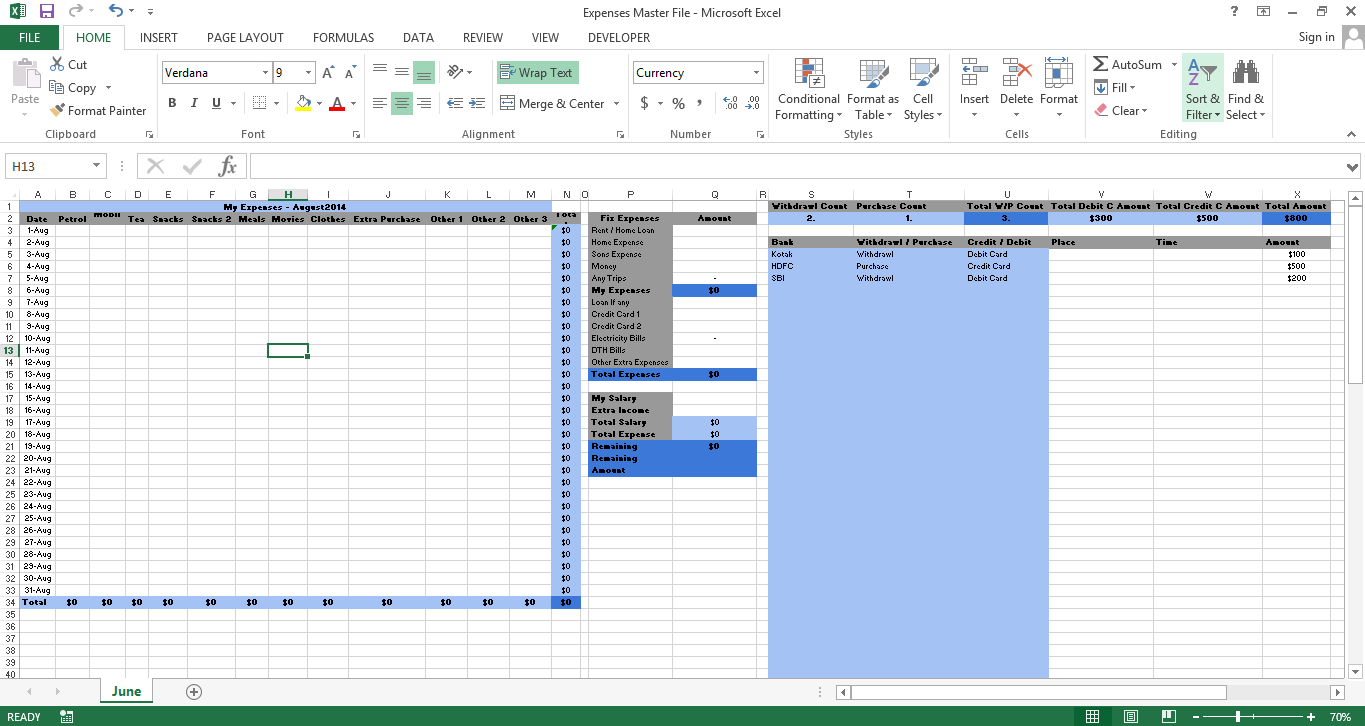

Handy Business Budget Templates (excel, Google Sheets) ᐅ Templatelab

Then we give our little stack of receipts to our manager or accounting department. We feel bad when they complain about the work we add to their day and we argue about expenses they can’t reimburse us for.

And as accountants and managers, we’ve all been in the position of seeing ourselves throwing away stacks of cash in the hope that we’ll have enough sense to pay our employees what they need.

If that sounds like you, then our free marketing report can help! For employees, it makes it easier to organize travel expenses. For employers, it can serve as a tax return or travel expense report. When your employees use a standard form, not only does it make their job easier, it also makes your accounting department’s job easier. Once your employees have created a payroll report and submitted it, along with verified receipts, you can use the document to directly pay employee expenses.

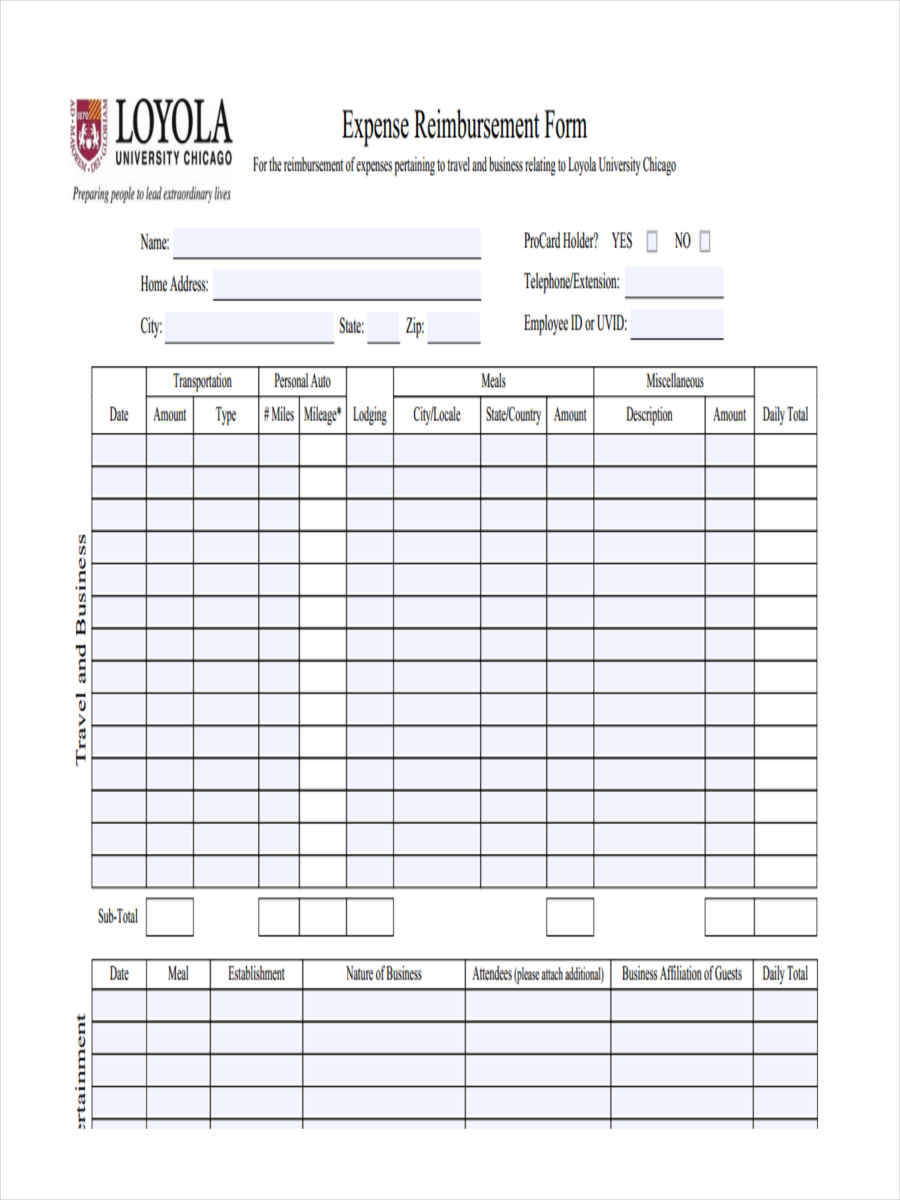

Travel Miscellaneous Expense Report Template

And remember – business travel can be both profitable and fun! Especially for part-timers. They break up the daily routine, help to work more efficiently and provide networking opportunities. Whether through interaction with colleagues or clients, business travel can remind us of the importance of doing what we do outside the walls of our business office.

(Note: There are two worksheets included in this download. The “Expense Report Form” uses US dollar formatting for financial cells. Calculate totals the same way. I’ll check the “Expense Report Form” expenses” in this article, but the instructions apply to both.

This income statement can be used as a digital document on your tablet or computer, or as a printout that you can take with you – or both. Print the spreadsheet, fill it out when you have expenses, then enter them in a digital version as you go. The digital control will automatically calculate the total under the display. See the sales report image to see the design and budgets included.

Employee Reimbursement Form Simple

There is only one worksheet in this easy-to-use sales report (called a template). This worksheet has a column for common currency units. But before you go on a business trip, please read your rental fee policy. Expenses incurred during your trip, and recorded on this professional expense report, are not reimbursable. Therefore, before spending any money, it is important to know what your employer thinks about “employee expenses” and “business travel expenses”. Also, it is important to keep track of receipts and credit cards. You need receipts as proof of payment for cash purchases and while credit card purchases are processed under the terms of the credit card, some employers also require receipts before refunding credit card purchases . This should be explained in your employer’s travel policy.

Most of this spreadsheet is self-explanatory because the fields are labeled. But I want to cover two points. First, all cells can be edited like normal Excel spreadsheet cells. Click on the phone and start typing. The cells you don’t modify are the numeric cells (L21: L39, E40: L40, L42, and L44). These sites contain formulas that calculate the sum of the row and column. Typing in one of these cells may produce an error or an incorrect total.

Let’s look at the SSN (social security number) field. If you are an employer, you will have recorded the social security numbers of your employees and you will not need to collect this information on this form. Since “identity theft is one of the fastest growing crimes in America” (Social Security Administration, Securing Today and Tomorrow), you may decide to collect the last four digits of the SSN, use them for an employee identification number or to use . This field is for various employee cost data.

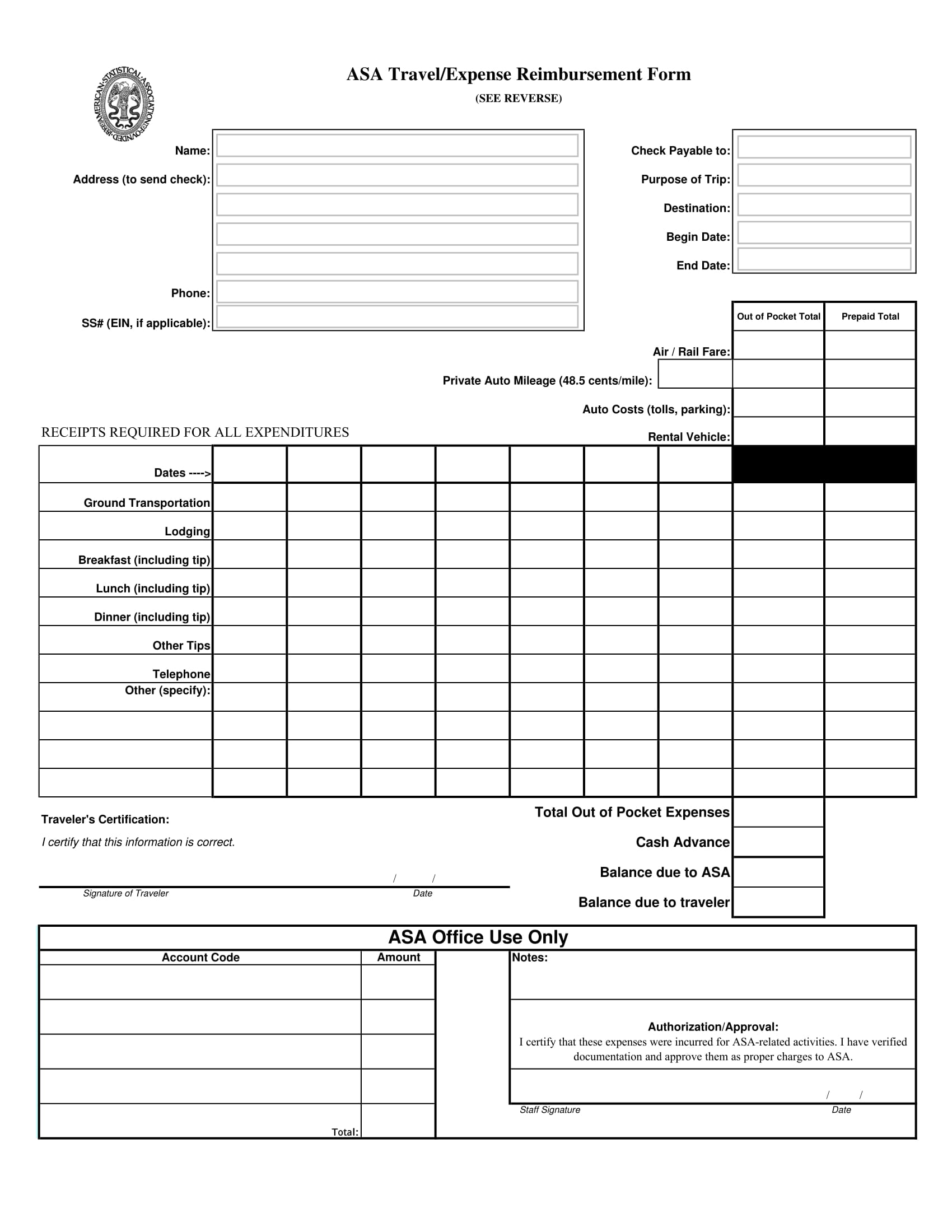

Expense Report Form

Simply select the phone (J17) and enter the new text (eg “Last four digits of SSN”). But there is another change we need to make. Output fields have an “input message” assigned to them. Input messages (also called toolbars) are messages in Excel that appear when you click on a cell. Look at the image of the input message – the tooltip is the highlighted yellow square that says “Enter Medicare number”.

So, using the input message image as a guide, after changing the label of the input field (1) and then selecting the input field (2), the input message appears (3). Note that the enrollment letter is based on the full social security number. We have to solve this problem. In the tool, open the “Data” tab, then select the “Data Validation” option – this will open the “Data Validation” window. In this window, open the “Entry Message” tab and change the “Entry Message” to “Enter the last four digits of the SSN” (see data verification image), or whatever information you have decided to apply in this line.

Another thing we need to point out is that column headers can be customized. As mentioned above, current categories are typically used in travel rental categories, but you may need to create a custom header for your application. To do this, just empty the title and write the new title. Row and column numbers are not based on the names of these headers. For example, there is a column for “Transportation” and “Fuel” but not for “Mileage”. In some cases, you may wish to report mileage compensation – the number of miles you have driven (usually in your own vehicle) multiplied by the mileage compensation rate (predetermined by your employer). The 2019 federal mileage reimbursement rate is 58 cents per mile. This fee is the refund you can claim on your federal income tax (less a portion of that amount reimbursed by your employer) for the use of your personal vehicle. Some employers will refund the full amount while others will only refund part of it, allowing you to claim the difference on your personal income tax. (Note: your tax situation may differ from the usual case and should be assessed by your tax advisor.) Now, to continue with our example, any “mileage reimbursement” should be calculated before putting it into the spreadsheet. So if you need to add a mileage column, you can add a header describing that number. See the mileage chart for an example and note that the calculation (0.58 cents x 100 miles = $58.00) is done before it is entered into the income statement.

Printable Expense Report

If you are trading in a currency other than US dollars, use the Expense Report Form No Currency. There is no money saved in this spreadsheet, and you can use it as a format or to paste money cells. Connect them with the euro. Highlight sites L21:L39, E40:L40, L42, and L44, then select the “Home” tab from the menu bar. Select the “Currency” menu and select “Euro” to compare my example (see currency image for results). You can change it to one of the other currencies from the same menu or select “More accounting formats…” for more currency options.

Let me add some data and create a rental report to help you understand this spreadsheet. Check out the sample expense report I prepared.

The sample data shows a two-day overnight trip to a conference and calculates the employee’s travel expenses. Each expense is on a single line (line) and listed in the appropriate column corresponding to the category. Remember that the columns are separated so you can see how much you spent in a category. If you don’t need the “Descriptions” details, you can add expenses on the same line. An example

Expense Reimbursement Form Excel

Template expenses claim form, travelling expenses claim form template, construction expenses excel template, business expenses form template, travel expenses form template, expenses template, expenses report template, expenses reimbursement form template, free expenses form template, expenses claim form template excel, template for expenses, expenses claim form template free

Thank you for visiting Expenses Form Template. There are a lot of beautiful templates out there, but it can be easy to feel like a lot of the best cost a ridiculous amount of money, require special design. And if at this time you are looking for information and ideas regarding the Expenses Form Template then, you are in the perfect place. Get this Expenses Form Template for free here. We hope this post Expenses Form Template inspired you and help you what you are looking for.

Expenses Form Template was posted in December 29, 2022 at 11:01 am. If you wanna have it as yours, please click the Pictures and you will go to click right mouse then Save Image As and Click Save and download the Expenses Form Template Picture.. Don’t forget to share this picture with others via Facebook, Twitter, Pinterest or other social medias! we do hope you'll get inspired by SampleTemplates123... Thanks again! If you have any DMCA issues on this post, please contact us!